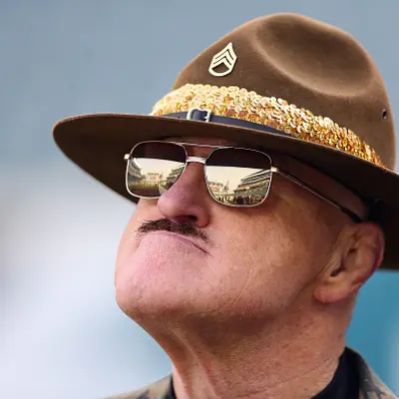

What Is Rick Perry’s Net Worth?

As of recent estimates, Rick Perry’s net worth is around $3 million. This valuation is based on his years of public service, real estate dealings, investments, and income from various sources, including his state pension and consulting work. It’s important to note that net worth figures are often estimates based on publicly available information, and the precise details of an individual’s finances can be difficult to ascertain.

Early Career and Political Rise

Rick Perry’s career began far from the political arena. After graduating from Texas A&M University, where he was a member of the Corps of Cadets and majored in Animal Science, Perry joined the Air Force. He served as a C-130 pilot, eventually achieving the rank of captain. Following his military service, Perry returned to his family’s cotton farm in Haskell County, Texas. This period marked his transition into politics. Perry’s initial foray into public service came in 1985 when he was elected to the Texas House of Representatives as a Democrat. He later switched to the Republican Party in 1989. In 1990, Perry successfully ran for Texas Agriculture Commissioner, a position he held until 1999. He then served as Lieutenant Governor under George W. Bush until Bush’s election to the presidency in 2000, which elevated Perry to the role of Governor of Texas.

Gubernatorial Income and Benefits

Rick Perry served as the 47th Governor of Texas from December 2000 to January 2015, making him the longest-serving governor in Texas history. His annual salary as governor was approximately $133,000. In addition to his salary, Perry received a state pension. A personal financial disclosure form revealed that Perry collected a $7,700 monthly state pension while also receiving his gubernatorial salary, a practice permissible under state law at the time. This “double-dipping” drew criticism, leading to legislative changes to prevent similar situations in the future.

Real Estate Investments and Land Deals

Throughout his career, Rick Perry engaged in several real estate transactions that significantly contributed to his wealth. These deals have been scrutinized for potential conflicts of interest, particularly due to Perry’s political connections. One notable transaction involved the sale of land to Michael Dell, the founder of Dell Computers. Perry sold a 9.3-acre tract in Austin to Dell for $465,000 in 1995, a property he had purchased for $122,000 in 1993, resulting in a $343,000 profit. Another significant deal occurred in 2001 when Perry bought lakefront property from his friend, State Senator Troy Fraser. He sold this property in 2007 for a profit of $823,766. In 2007, Perry sold a piece of real estate on Lake LBJ near Austin for $1.14 million. These real estate ventures helped Perry earn approximately $2 million in pre-tax profits since the early 1990s.

Post-Gubernatorial Activities and Consulting Income

After leaving the governor’s office in 2015, Rick Perry pursued various private sector opportunities. He joined the board of directors of Energy Transfer Partners and Sunoco Partners, both major energy companies. According to SEC filings, he resigned from these boards in December 2016. In early 2020, Perry rejoined the board of LE GP, the general partner of Energy Transfer. He also rejoined MCNA Dental’s board of directors as chief strategy officer and vice chairman in February 2020. In 2015, Perry reported consulting income of $250,000 from Holt Texas Ltd. (Holt Cat), a company owned by a major donor. He also earned $96,000 in honorariums for speeches given in April 2015, addressing organizations such as the Asian American Hotel Owners Association and Microsoft.

Investments and Assets

Rick Perry’s financial disclosures reveal a diverse portfolio of investments. In 2016, his assets included holdings in Sunoco Logistics Partners (valued between $101,002 and $265,000), a residential rental property in San Antonio, TX (valued between $100,001 and $250,000), Grey Rock Energy Fund I (valued between $100,001 and $250,000), and Energy Transfer Partners (valued between $100,001 and $250,000). He also held cash accounts at U.S. financial institutions (valued between $100,001 and $250,000). Other investments included mutual funds like Templeton Foreign VIP fund, T Rowe Price Growth, SPDR Gold Trust Gold Shares, LVIP Wellington Capital Growth SC, LVIP MFS Value Fund, and LVIP Delaware Bond, each valued between $50,001 and $100,000. Perry also had investments in individual companies such as Fairmount Santrol Holdings and Tesla Motors. His wife, Anita Perry, held stock in companies involved in artificial intelligence and machine learning, including Verizon, AT&T, and Splunk. These investments were reported in a range of values, totaling between $17,000 and $80,000 in 2019.

Secretary of Energy Role

From 2017 to 2019, Rick Perry served as the United States Secretary of Energy under President Donald Trump. During his tenure, he oversaw the Department of Energy’s budget and initiatives. In 2017, Perry announced a $30 million investment in advanced nuclear technology. In 2019, he established an Office for Artificial Intelligence and Technology within the Department of Energy and allocated $119 million in funding for AI in 2020. His wife’s investments in AI-related companies raised potential conflict-of-interest concerns.

Book Sales and Publications

Rick Perry has authored several books, contributing to his income. His 2010 book, “Fed Up!: Our Fight to Save America from Washington,” criticized the federal government and promoted states’ rights. Perry’s book sales, while not as high as some other political figures, added to his overall financial profile. A 2024 biography, “Rick Perry: A Political Life” by Brandon Rottinghaus, chronicles his career and impact on Texas politics.

Blind Trust

In 1996, Rick Perry placed a significant portion of his assets into a blind trust to avoid potential conflicts of interest. While the exact holdings of the trust were not publicly known, aides estimated its value at $896,000 in 2009. The blind trust was designed to create a legal separation between Perry’s public service and his personal business dealings, but it also made it difficult to track the specifics of his investments and financial activities.

Net Worth Ranker

Net Worth Ranker