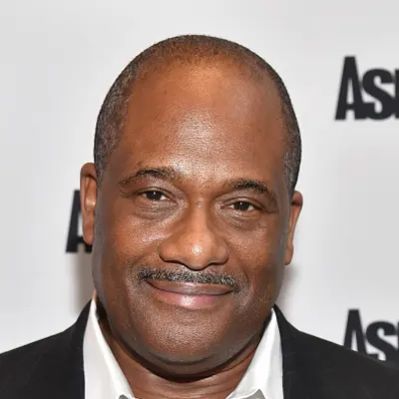

What Is Irving Azoff’s Net Worth?

Irving Azoff, a prominent figure in the entertainment industry, has accumulated a substantial net worth of $400 million. This wealth is primarily derived from his extensive career as an executive, manager, and entrepreneur in the music and entertainment sectors. His involvement in various successful ventures, including Front Line Management, Ticketmaster, Live Nation Entertainment, and Global Music Rights, has significantly contributed to his financial standing.

Irving Azoff’s Career Milestones and Financial Achievements

Azoff’s career began in the early 1970s, managing bands such as REO Speedwagon and Dan Fogelberg. In 1972, he moved to Los Angeles and joined Geffen-Roberts Management, where he started working with the Eagles. This marked the beginning of a long and fruitful relationship with the band, spanning over four decades. His keen business acumen and ability to identify and nurture talent led to significant financial gains throughout his career.

In 1983, Azoff became the chairman of MCA Music Entertainment Group. During his six-year tenure, he transformed the struggling label into a profitable entity. His strategic decisions, such as acquiring the distribution rights for Motown and signing teen star Tiffany, revitalized the label’s financial performance. Although specific revenue figures from these deals are not publicly available, industry analysts at the time estimated that the Motown deal alone added tens of millions of dollars to MCA’s bottom line.

After leaving MCA, Azoff founded Giant Records, which achieved early success with acts like Color Me Badd and the “New Jack City” soundtrack. While specific financial details about Giant Records’ revenue and profits during Azoff’s leadership are not fully disclosed, the label’s success contributed to his overall net worth. He returned to artist management, demonstrating his continued ability to generate substantial income through his management expertise. Azoff’s success in orchestrating the Eagles’ reunion album and tour in 1994 further solidified his reputation as a top-tier manager, earning him significant commissions from the band’s earnings.

In October 2008, Ticketmaster acquired Front Line Management, and Azoff became the CEO of Ticketmaster. In February 2011, he was named the chairman of Live Nation. This move positioned him at the helm of two of the largest companies in the ticketing and live entertainment industries. Although his specific compensation package as CEO and chairman was not publicly disclosed, executive positions at this level typically command multi-million-dollar salaries and stock options, significantly boosting his net worth.

Azoff founded Global Music Rights (GMR) in 2013, a performance rights organization that administers publishing for artists like John Lennon, George Harrison, Bruno Mars, Pearl Jam, Metallica, and Bruce Springsteen. GMR’s establishment marked a strategic move to challenge the dominance of established performance rights organizations like ASCAP and BMI. While GMR’s specific revenue figures are not publicly available, performance rights organizations collect substantial royalties from the public performance of songs, which are then distributed to songwriters and publishers. As the founder and CEO of GMR, Azoff likely receives a significant share of the company’s profits. Furthermore, in 2013, Azoff unveiled Azoff MSG Entertainment, a venture with The Madison Square Garden Company (MSG). He served as chairman and CEO and also worked as a consultant to MSG. Financial terms of this venture, including his salary and equity stake, were not fully disclosed, but this role would have contributed to his overall compensation. In 2015, he co-founded Oak View Group along with Tim Leiweke, further expanding his business interests.

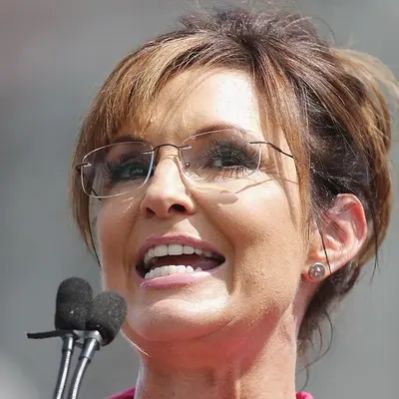

In 2018, Azoff co-founded Iconic Artists Group with Oliver Chastan, an entertainment rights management company. The group acquired the catalogs or interests in several major artists, including David Crosby and The Beach Boys. The acquisition prices for these catalogs are typically based on a multiple of the catalog’s annual revenue, potentially ranging from 10 to 20 times the annual royalty income. These acquisitions demonstrate Azoff’s ongoing investment in the music industry and contribute to the growth of Iconic Artists Group, further increasing his financial stake in the entertainment sector. Though, in 2018, Nicki Minaj accused Azoff of orchestrating a smear campaign against her upcoming tour, but the issues were reconciled and he became Minaj’s manager.

Azoff’s influence extends beyond music management; he has also co-produced several popular movies, including “Fast Times at Ridgemont High,” “Urban Cowboy,” “Jack Frost,” “Above the Rim,” and “The Inkwell.” While his specific earnings from these film productions are not publicly disclosed, successful film producers often receive a percentage of the film’s profits, which can amount to significant sums for box office hits.

Irving Azoff’s Real Estate Holdings

Irving and Shelli Azoff have made significant investments in real estate. In 2012, they sold an oceanfront home in Malibu for $10 million. They continue to own several other properties in Malibu, including one that spans 12 acres. Specific addresses of these properties are not publicly available. Additionally, they own a number of houses in La Quinta, California, and a mansion in Snowmass, Colorado. The values of these properties contribute significantly to Azoff’s overall net worth. Given the prime locations and size of these holdings, their combined value is estimated to be in the tens of millions of dollars.

Other Investments and Ventures

Beyond his entertainment industry endeavors and real estate holdings, Azoff has also invested in the restaurant business. The couple purchased The Apple Pan, one of Los Angeles’ oldest operating restaurants. Soon after, they purchased another restaurant, Nate n Al’s, with a consortium of Los Angeles-based investors. Specific financial details of these investments, such as the purchase prices and ownership percentages, are not publicly available. However, owning and operating well-established restaurants in Los Angeles can be a profitable venture, adding another stream of income to Azoff’s portfolio. The Apple Pan is located at 10801 W Pico Blvd, Los Angeles, CA 90064, and Nate n Al’s is located at 414 N Beverly Dr, Beverly Hills, CA 90210.

While information about specific luxury assets like private jets and cars is not readily available in the public domain, individuals with a net worth of $400 million often possess such high-value assets. These assets, while not directly contributing to his income, are indicative of his financial success and lifestyle. Information concerning specific details regarding investments, yearly income statistics, and net worth milestones are not fully disclosed to the public.

Net Worth Ranker

Net Worth Ranker