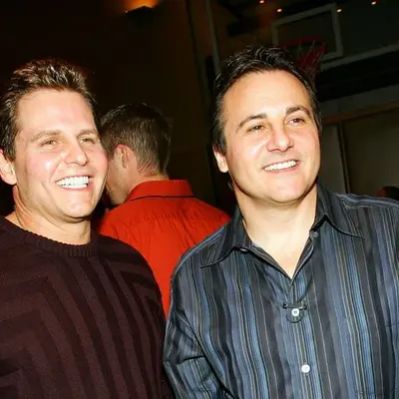

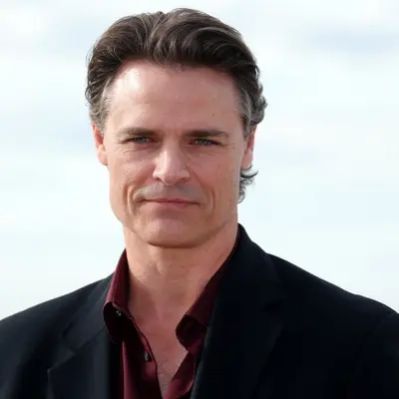

What Is Steve Pagliuca’s Net Worth

Steve Pagliuca, an American private equity investor and businessman, has accumulated a significant net worth estimated at $450 million. This valuation primarily reflects his long and successful career in finance, particularly his involvement with Bain Capital and his ownership stake in the Boston Celtics. While the precise breakdown of his assets remains largely private, we can infer the major components of his net worth based on publicly available information.

Sources of Steve Pagliuca’s Net Worth

A substantial portion of Steve Pagliuca’s net worth is derived from his role as a Managing Partner at Bain Capital. Bain Capital, a global private equity firm, manages billions of dollars in assets, generating significant profits through investments in various industries. Specific details of his compensation structure at Bain Capital are not publicly disclosed. However, managing partners in such firms typically receive a share of the profits generated by the funds they manage, along with a base salary and carried interest. Given Bain Capital’s extensive portfolio and successful track record, it’s reasonable to assume that Pagliuca’s earnings from this source have been substantial over the years.

His ownership stake in the Boston Celtics also contributes significantly to his overall net worth. In 2003, Pagliuca was part of a consortium known as Boston Basketball Partners LLC, which acquired the Boston Celtics for $360 million. While the exact percentage of his ownership is not publicly available, valuations of professional sports teams have increased dramatically since then. The Boston Celtics are now worth an estimated $4.7 billion as of October 2024, according to Forbes. Even a relatively small ownership stake would translate into a considerable asset.

Beyond his roles at Bain Capital and the Boston Celtics, Pagliuca may have other investments in various businesses and real estate holdings. Information on these investments is limited, as most are not publicly disclosed. He also co-owns Serie A team Atalanta which he and a group of investors purchased 55% ownership of in February 2022. However, given his financial acumen and extensive network, it’s plausible that he has diversified his portfolio with other assets that contribute to his overall wealth.

Early Career and Education

Steve Pagliuca’s path to becoming a successful private equity investor began with a solid educational foundation. He earned his undergraduate degree from Duke University, providing him with a strong academic background. He further enhanced his business knowledge by obtaining an MBA from Harvard Business School, a prestigious institution that has produced numerous business leaders. Details about his scholarships or any specific financial challenges he faced during his education are not publicly available, but his attendance at these top-tier institutions laid the groundwork for his future success.

His early professional experience involved working as a Senior Accountant and International Tax Specialist for Peat Marwick Mitchell & Company (now KPMG) in the Netherlands. While specific salary figures from this period are not publicly known, working overseas in an international tax role would have provided him with valuable experience and a foundation for his future career in finance. This experience likely exposed him to international business practices and financial strategies that would later prove beneficial in his private equity endeavors.

Bain Capital Career

Pagliuca joined Bain & Company and later Bain Capital in the late 1980s, a pivotal moment in his career trajectory. Specifics about his initial salary and compensation package at Bain are not publicly accessible. However, joining a firm like Bain Capital at that time would have positioned him for significant financial rewards as the private equity industry experienced substantial growth. Rising through the ranks to become a Managing Partner suggests that he consistently delivered strong results and contributed to the firm’s success. This role provides a direct share of the firm’s profits, contributing to his rising net worth.

Over the years, Pagliuca has likely been involved in numerous high-profile deals and investments at Bain Capital. While specific details of these transactions are typically confidential, his role as a Managing Partner would have given him significant influence over investment decisions and the overall strategic direction of the firm. His involvement in these deals has undoubtedly contributed to the growth of his personal wealth. In April 2024, Bain Capital launched a new fund with $3.1 billion to invest in healthcare companies.

Boston Celtics Ownership

Pagliuca’s involvement with the Boston Celtics began in 2003 when Boston Basketball Partners LLC acquired the team for $360 million. While the exact details of his investment and ownership stake remain private, the value of professional sports teams has soared since then. As of October 2024, the Boston Celtics are estimated to be worth $4.7 billion, which is nearly 13 times the original purchase price, according to Forbes. This increase in valuation would have significantly boosted the value of Pagliuca’s investment. Details surrounding annual dividends or profits distributed to owners are not publicly accessible.

As part-owner of the Celtics, Pagliuca has likely benefited from the team’s success on and off the court. The Celtics have won multiple championships since he became part-owner, increasing the team’s brand value and fan base. While specific details about his financial involvement in the team’s operations are not available, his ownership stake has undoubtedly been a valuable asset.

Political Activities

In 2009, Pagliuca ran as a candidate in a special election in Massachusetts to fill the U.S. Senate seat left vacant by Ted Kennedy. He finished fourth in the primary election. Information on the specific amount of money he spent on his campaign is publicly available through campaign finance disclosures. Although he was not successful in his political bid, his willingness to invest time and resources into the campaign demonstrates his commitment to public service and his interest in shaping public policy. Specifics regarding donations he has made to other campaigns are not publicly available.

Other Investments and Assets

While the majority of publicly available information focuses on his involvement with Bain Capital and the Boston Celtics, Steve Pagliuca may have other investments in various businesses and real estate holdings. Information on these investments is limited, as most are not publicly disclosed. He co-owns Serie A team Atalanta which he and a group of investors purchased 55% ownership of in February 2022. Specifics regarding the exact valuation and revenue he gains from his partial ownership is not publicly available.

Philanthropy

While not directly impacting his net worth, Pagliuca’s philanthropic endeavors showcase his commitment to giving back to the community. Specific details about his charitable donations and the organizations he supports are often private. However, it is common for individuals with significant wealth to engage in philanthropy through private foundations or direct donations to charitable organizations. These activities can range from supporting educational initiatives to funding medical research and community development programs. The extent and nature of Pagliuca’s philanthropic activities are not fully detailed in publicly available sources.

Summary of Steve Pagliuca’s Net Worth Components

In summary, Steve Pagliuca’s $450 million net worth is primarily derived from his successful career in private equity and his ownership stake in the Boston Celtics. While the exact breakdown of his assets remains confidential, his position as a Managing Partner at Bain Capital and his ownership stake in a highly valued sports franchise have been the primary drivers of his wealth. He co-owns Serie A team Atalanta which he and a group of investors purchased 55% ownership of in February 2022. His early career experience, education, and potential other investments have also likely contributed to his financial success. While information on his personal lifestyle and spending habits is limited, it is clear that his financial acumen and business ventures have allowed him to accumulate substantial wealth.

Net Worth Ranker

Net Worth Ranker