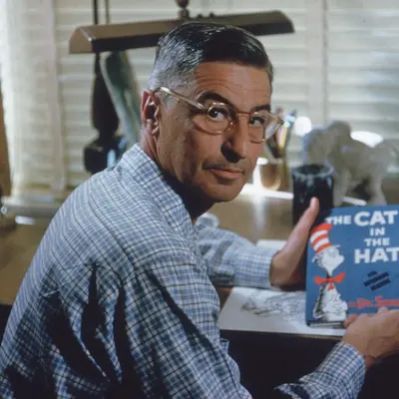

What Is Jim Cramer’s Net Worth?

Jim Cramer, a well-known American television personality, author, and former hedge fund manager, has accumulated a substantial net worth estimated at $150 million. This financial success is attributed to his multifaceted career, which includes hosting CNBC’s “Mad Money,” co-founding TheStreet.com, and managing his own hedge fund.

Jim Cramer’s Salary and Income Streams

Cramer’s annual salary from his various roles at CNBC amounts to $5 million. In addition to his salary, he generates significant income from book royalties and advances, reflecting his success as an author. He has penned several books, including “Confessions of a Street Addict,” “You Got Screwed! Why Wall Street Tanked and How You Can Prosper,” “Jim Cramer’s Real Money: Sane Investing in an Insane World,” “Jim Cramer’s Stay Mad for Life: Get Rich, Stay Rich (Make Your Kids Even Richer),” “Jim Cramer’s Getting Back to Even,” and “Jim Cramer’s Get Rich Carefully,” each contributing to his overall income through royalties and advances.

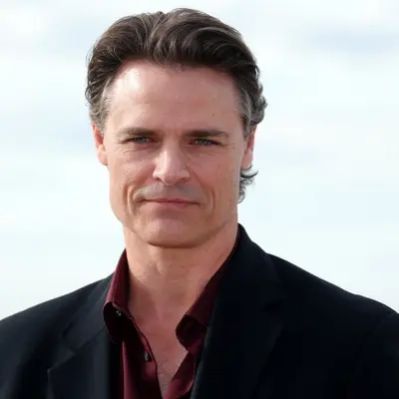

Early Career and Education

James J. Cramer was born on February 10, 1955, in Wyndmoor, Pennsylvania. His mother, Louise A. Cramer, was an artist, and his father, Ken Cramer, owned International Packaging Products. Cramer’s early work experience included selling Coca-Cola and ice cream at Veterans Stadium during Philadelphia Phillies games in the early 1970s. He attended Springfield Township High School before pursuing higher education at Harvard College, where he studied government. He graduated magna cum laude in 1977 with a Bachelor of Arts degree. During his time at Harvard, he was involved in The Harvard Crimson, serving as the publication’s President and Editor-in-Chief. Following graduation, Cramer worked as a reporter at the Tallahassee Democrat in Tallahassee, Florida, covering the Ted Bundy murders. He later worked at the Los Angeles Herald-Examiner, American Lawyer, and for California Governor Jerry Brown. He returned to Harvard to attend law school. While a law student, he invested in the stock market, using his trading profits to cover his tuition costs.

Goldman Sachs and Hedge Fund Management

After graduating from Harvard Law in 1984, Cramer joined Goldman Sachs as a stockbroker. Although he was admitted to the New York State Bar Association in 1985, he did not practice law. In 1987, Cramer left Goldman Sachs to establish his own hedge fund, Cramer & Co. (later Cramer, Berkowitz & Co.). He raised $450 million in $5 million increments, charging a fee of 20% of the profits he generated. Notable early investors in his hedge fund included Steve Brill, Eliot Spitzer, and Martin Peretz. He retired from the hedge fund in 2001, with his former partner, Jeff Berkowitz, taking over. Cramer has stated that from 1988 to 2000, he had only one year of negative returns, in 1998, and that he achieved an average annual return of 24% over 14 years.

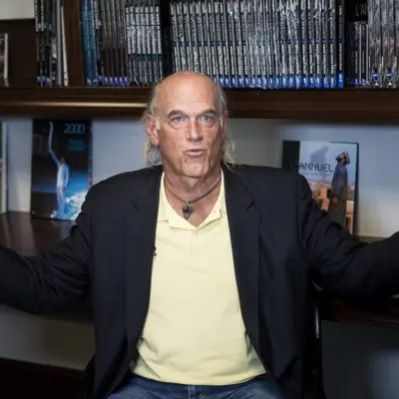

TheStreet.com and Other Ventures

In 1996, Cramer co-founded TheStreet.com, a financial news and literacy website, with Martin Peretz. The website was sold to TheMaven in 2019 for $16.5 million. Cramer also worked at SmartMoney magazine as an “editor at large.” During the late 1990s, Cramer frequently appeared as a guest commentator on CNBC. He eventually hosted his own show, “Kudlow & Cramer,” with Larry Kudlow from 2002 to 2005. In 2005, he began hosting “Mad Money with Jim Cramer” on CNBC. The show aims to provide viewers with tools and knowledge to become better investors. Cramer is required to disclose any positions he holds in stocks discussed on the show and is prohibited from trading in those stocks for five days following each broadcast. In 2005, Cramer told BusinessWeek that his net worth was in the $50 – $100 million range. At the peak of the dot-com bubble, Cramer’s net worth was significantly higher, thanks largely to his 15% stake in TheStreet.com. In 1999, soon after going public, TheStreet.com had a market cap of $1.7 billion. At that level, Cramer’s 15% stake was worth $255 million. Fast forward to 2005, post dotcom crash and that stake was worth around $15 million.

Real Estate Holdings and Personal Life

Cramer was married to Karen Backfisch from 1988 to 2009, and they have two children together. He married Lisa Cadette Detwiler, a real estate broker and general manager of The Longshoreman restaurant in New York City, in April 2015. He owns several properties, including the DeBary Inn in Summit, New Jersey, purchased with four other investors in 2009, and Bar San Miguel, a restaurant and bar in Carroll Gardens, Brooklyn, co-owned with his wife. He resides in Summit, New Jersey, and also owns private residential properties in Quogue, New York, on Long Island, as well as a 65-acre estate in the New Jersey countryside. In 1999, Jim and Karen paid $2.375 million for a 100+ year old home on 1.33 acres in Summit, New Jersey. As part of their divorce settlement, Jim sold the house to Karen for $1. Karen sold the house in April 2019 for $3.675 million. In 2008, Jim paid $4.7 million for a different home in Summit, New Jersey.

Cramer’s Investment in TheStreet.com

Cramer’s early investment and involvement with TheStreet.com significantly impacted his net worth, especially during the dot-com boom. His stake in the company, which reached a market capitalization of $1.7 billion shortly after going public in 1999, was valued at $255 million at its peak. However, following the dot-com crash, the value of his stake decreased to approximately $15 million by 2005. This experience highlights the volatility of the stock market and the potential for rapid gains and losses.

“Mad Money” and CNBC Career

Cramer’s role as the host of “Mad Money with Jim Cramer” on CNBC has been a key factor in his financial success. The show, which began airing in 2005, provides viewers with investment advice and insights, helping them to become more informed investors. As a condition of his employment at CNBC, Cramer is required to disclose any positions he holds in stocks discussed on the show and is prohibited from trading in those stocks for five days following each broadcast. This transparency helps to maintain the integrity of the show and ensures that Cramer’s advice is not influenced by his personal investments. The show “Mad Money” was actually inspired by this one-hour radio show he had previously hosted, “Jim Cramer’s Real Money,” which ended in December 2006.

Net Worth Ranker

Net Worth Ranker