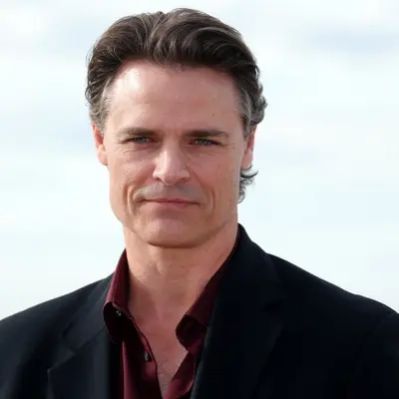

What Is Jim Balsillie’s Net Worth

James “Jim” Balsillie, the Canadian businessman best known for his role in Research in Motion (RIM), later BlackBerry, has a net worth of $800 million as of February 2025. This valuation reflects his business ventures, primarily his involvement with RIM, and his subsequent entrepreneurial and philanthropic activities. At its peak, Balsillie’s net worth reached $2.3 billion, highlighting the substantial financial impact of BlackBerry’s rise and fall in the mobile technology market.

Early Life and Education

Jim Balsillie was born on February 3, 1961, in Seaforth, Ontario, Canada. His parents are Laurel and Raymond Balsillie. When Jim was five, his family relocated to Peterborough, Ontario. Balsillie’s pursuit of higher education led him to Trinity College at the University of Toronto, where he completed a Bachelor of Commerce degree in 1984. He furthered his academic qualifications by earning a Master of Business Administration (MBA) degree from Harvard Business School in 1989. There are no publicly available details on the specific costs associated with his education at these institutions.

Career Beginnings and Transition to Research in Motion (RIM)

After graduating from Harvard Business School in 1989, Jim Balsillie took on the role of executive vice president and CFO of technology at Sutherland-Schultz, a design and construction services company located in Cambridge, Ontario. Specific financial details of his compensation and the exact profits earned during his tenure are not publicly accessible. He stayed with Sutherland-Schultz until 1992, when the Vollmer Group acquired the company. Following this acquisition, Balsillie ventured into the software industry, making his initial investment of $125,000 in Research in Motion (RIM) in 1992. Simultaneously, he joined the company as its co-CEO alongside co-founder Mike Lazaridis. Specifics regarding the negotiation of the equity split upon joining RIM remain confidential. Balsillie primarily managed the sales and accounting aspects of the business, complementing Lazaridis’s focus on technology.

Research in Motion (RIM)/BlackBerry: Rise and Fall

Under the co-leadership of Jim Balsillie and Mike Lazaridis, Research in Motion (RIM) experienced significant success throughout the 1990s. The BlackBerry brand dominated the mobile phone and pager industries, and the company achieved substantial market share. However, the emergence of Apple’s iPhone and Google’s Android operating system in the 2000s presented serious challenges. These competitors eventually overtook BlackBerry in market dominance. The exact figures of BlackBerry’s market share decline year-over-year are well documented, highlighting the shift in consumer preferences and technological advancements. Balsillie resigned from his position as chairman of RIM in 2007 but remained co-CEO and a director. This transition involved internal company restructuring but specific details of his compensation package at the time are not fully public. In 2009, Balsillie was compelled to resign from his director role at RIM due to past stock option accounting errors. The Ontario Securities Commission (OSC) deemed these errors a “fundamental failure of governance.” Financial penalties and sanctions were imposed, but the exact amounts are not specified in the available documents. He was reappointed to the board in 2010 after the OSC sanctions expired, and these details can be found in regulatory filings. By the end of 2011, Balsillie was the third-largest shareholder in RIM. However, the company’s struggles were evident as they cut 2,000 employees, and share value declined sharply. In early 2012, Balsillie and Lazaridis stepped down as co-CEOs. Thorsten Heins replaced them. Two months later, Balsillie resigned from the board due to disagreements with Heins. Specific details on the severance packages and terms of his departure from RIM remain confidential, as is the precise value of his remaining shareholdings at the time.

NHL Ownership Bids

Jim Balsillie made three attempts to purchase a National Hockey League (NHL) franchise with the goal of relocating it to Hamilton, Ontario. In 2006, he bid $185 million to acquire the Pittsburgh Penguins. However, he withdrew the bid two months later. Specifics on the reasons for the withdrawal and any associated financial implications are not available publicly. In 2007, Balsillie tentatively agreed to purchase the Nashville Predators from Craig Leipold. Leipold ultimately declined to sign the agreement. Detailed information regarding the purchase price and financial terms that were tentatively agreed upon have not been disclosed. In 2009, Balsillie offered to buy the Phoenix Coyotes following the team’s bankruptcy protection filing in Arizona. Judge Redfield T. Baum rejected his bid, preventing him from making the purchase from the bankruptcy trustee. The precise amount of Balsillie’s offer and the reasons for the judge’s rejection are documented in court records but the full details are complex and lengthy.

Philanthropy: The Centre for International Governance Innovation (CIGI)

Jim Balsillie is significantly involved in philanthropy. He founded the Centre for International Governance Innovation (CIGI) in 2001. CIGI is an independent, non-partisan think tank based in Waterloo, Ontario. It supports research, creates networks, and promotes policy debate. While the exact amount of Balsillie’s financial contributions to CIGI over the years is not fully disclosed, CIGI’s annual reports provide an overview of its funding and expenditures. In 2007, Balsillie founded the Balsillie School of International Affairs (BSIA) in collaboration with CIGI, the University of Waterloo, and Wilfrid Laurier University. BSIA is housed in the north and west wings of the CIGI Campus. The BSIA’s budget and Balsillie’s specific financial contributions are not detailed in publicly accessible documents. Balsillie also founded and chairs the Canadian Council of Innovators.

Personal Life

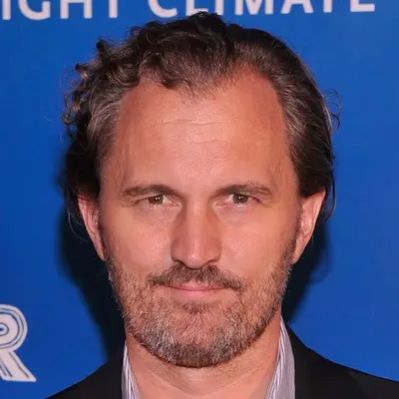

Jim Balsillie was married to Heidi from 1989 until their separation in 2011. They have two children, James and Rachel. Details about the terms of their separation, including any potential settlement amounts, have not been disclosed publicly. In 2023, Glenn Howerton portrayed Balsillie in the biographical film “BlackBerry”. There are no publicly available details about the financial arrangements or compensation involved in the production of the film.

BlackBerry’s Stock Decline and Impact on Jim Balsillie’s Net Worth

The significant decline in Research in Motion’s (RIM) stock value was a major factor in reducing Jim Balsillie’s net worth from its peak of $2.3 billion. As Apple’s iPhone and Google’s Android gained dominance in the cell phone market, RIM’s share value experienced a steep decline. While specific percentages and timelines of this decline are readily available through stock market data, the precise value of Balsillie’s individual holdings and losses during this period are not detailed in publicly accessible records. The factors contributing to this decline included RIM’s slow response to changing consumer preferences, technological advancements, and the overall competitive landscape of the mobile phone industry.

Jim Balsillie’s Other Investments and Assets

Beyond his involvement with Research in Motion (RIM) and his philanthropic activities, specific details about Jim Balsillie’s other investments and assets are not widely publicized. Financial records detailing his investment portfolio, including stocks, bonds, real estate holdings, and other business ventures, are typically kept private. While there may be publicly available information on certain holdings through regulatory filings or company disclosures, a comprehensive overview of his assets is not accessible. These investments may include private equity, venture capital, or other business interests. In addition to his business and philanthropic endeavors, Jim Balsillie may also possess personal assets such as real estate, vehicles, and other valuables. However, the precise value and details of these assets are not included in publicly accessible databases. Balsillie’s approach to managing his financial assets and investment strategies is also not part of the public record. He is understood to have other private ventures that have not been widely publicized, specifics on these ventures are not readily available.

Real Estate Holdings and Properties

Specific details regarding Jim Balsillie’s real estate holdings and properties are not comprehensively available in the public domain. Information about the precise addresses, sizes, and values of his real estate assets is typically considered private. While there may be occasional news reports or public records that mention specific properties owned or associated with Balsillie, a complete and detailed list of his real estate portfolio is not accessible. It is known that Jim Balsillie maintains a residence in the Waterloo region of Ontario, given his extensive involvement with organizations and initiatives in the area. However, the exact location, features, and value of this property are not widely publicized. In addition, he may own or have owned other properties in different locations, but information about these holdings is not included in publicly available databases. Due to privacy considerations, the exact details of his real estate holdings and properties remain largely undisclosed.

Net Worth Ranker

Net Worth Ranker