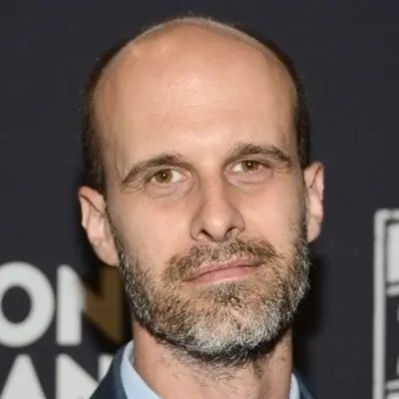

What Is James Altucher’s Net Worth?

James Altucher, a multifaceted figure in the realms of finance, entrepreneurship, and media, boasts a net worth estimated at $50 million. This substantial wealth is not the result of a single venture, but rather the culmination of diverse income streams derived from his entrepreneurial endeavors, investments, writing, and media appearances.

Entrepreneurial Ventures and Investment Acumen

Altucher’s entrepreneurial journey is marked by the founding or co-founding of over 20 companies across a spectrum of industries. While not all of these ventures achieved blockbuster success, several yielded substantial returns, contributing significantly to his overall James Altucher net worth. Two notable exits include Reset Inc., a web design firm he founded in 1996, which built websites for entertainment giants like HBO, Miramax, and New Line Cinema, and StockPickr, an online social network for investors established in 2006. StockPickr was acquired by TheStreet.com, owned by Jim Cramer, in 2007 for approximately $10 million. These successful ventures provided substantial capital injections, which Altucher has reinvested into other opportunities.

Beyond founding companies, Altucher has actively engaged in angel investing, backing numerous startups and demonstrating a keen eye for identifying promising ventures in their nascent stages. His early advocacy of cryptocurrency, particularly Bitcoin, further underscores his forward-looking investment strategy and willingness to embrace emerging technologies. While the specific details of his cryptocurrency holdings remain private, his early adoption positioned him to capitalize on the explosive growth of the digital asset market. His investment strategy is also characterized by his contrarian stance on traditional financial advice. He has publicly questioned the wisdom of homeownership as an investment, advocating instead for prioritizing self-investment through skill development and personal projects.

From 2002 to 2005, Altucher gained experience trading for several hedge funds, and he eventually became managing director of Formula Capital, a fund of hedge funds and asset management firm. In that role, he gained experience managing portfolios and crafting investment strategies, further enhancing his reputation in the financial world. This experience allowed him to fine-tune his investment strategies and generate returns that contributed to his James Altucher net worth.

Authorship, Media Influence, and Royalties

Altucher’s influence extends beyond the business world into the realm of media, where he has established himself as a prolific author and sought-after commentator. He has penned over 20 books, covering a wide range of topics from finance and self-improvement to entrepreneurship and personal development. Some of his most notable titles include “Choose Yourself” (2013), which became a bestseller and a manifesto for entrepreneurial empowerment, “Reinvent Yourself” (2017), which offers strategies for personal and professional transformation, and “The Power of No” (2014), co-authored with his wife, Claudia Azula Altucher. These books generate revenue through sales, royalties, and speaking engagements, adding a steady stream of income to his overall James Altucher net worth.

Beyond book sales, Altucher’s online presence has further amplified his influence and income-generating potential. His blog, “The Altucher Confidential,” launched in 2010, has amassed a substantial following, attracting over 10 million readers with its blend of financial advice and personal anecdotes. The blog generates revenue through advertising, sponsorships, and affiliate marketing, contributing to his overall income. He has also been a frequent contributor to prominent publications such as The Financial Times, TheStreet.com, TechCrunch, Seeking Alpha, and Thought Catalog, further expanding his reach and earning potential.

In 2014, Altucher launched “The James Altucher Show,” a podcast featuring interviews with entrepreneurs, authors, and thought leaders. The podcast has achieved considerable popularity, consistently ranking high in business podcast charts and attracting millions of downloads. The podcast generates revenue through advertising, sponsorships, and affiliate marketing, further diversifying his income streams and contributing to his James Altucher net worth.

Early Life and Education

James Altucher was born on January 22, 1968, in New York City. He spent his formative years in a middle-class household, nurturing an early interest in technology and chess. Altucher attended North Brunswick Township High School in New Jersey, graduating in 1986. One of his classmates was future comedian/radio host Jim Norton. He then pursued higher education at Cornell University, earning a bachelor’s degree in computer science in 1989. He continued his academic pursuits with graduate studies in computer science at Carnegie Mellon University. During his college years, Altucher honed his chess skills, achieving the rank of chess master. This combination of technical education and strategic thinking laid the foundation for his future entrepreneurial ventures. While these early experiences did not directly contribute to his monetary James Altucher net worth, they shaped his intellectual development and provided a foundation for his future success.

Career Beginnings and HBO

After completing his education, Altucher embarked on a career in the IT sector. In the early 1990s, he worked in the IT department at HBO, where he played a role in creating one of the company’s first internal websites. He even ventured into web series production, creating “III:am,” featuring late-night New York City interviews. While his early work at HBO may not have directly translated into significant financial gains, it provided valuable experience in web development and content creation, which later proved instrumental in his entrepreneurial ventures.

Reset Inc. and the Dot-Com Boom

In 1996, Altucher capitalized on the burgeoning internet boom by founding Reset Inc., a web design firm that catered to entertainment companies such as HBO, Miramax, and New Line Cinema. The specific financial details of Reset Inc.’s revenues and expenses are not publicly available, however, the sale of Reset Inc. marked his first major entrepreneurial success, providing him with the capital to pursue further ventures and investments. While the exact sale price remains undisclosed, it is believed to have been a substantial sum, contributing significantly to his initial accumulation of wealth.

StockPickr and TheStreet.com Acquisition

In 2006, Altucher founded StockPickr, an online social network for investors that allowed users to share investment ideas and track portfolios. Within a year, StockPickr caught the attention of Jim Cramer’s TheStreet.com, which acquired the company for approximately $10 million in 2007. This acquisition represented a significant milestone in Altucher’s career, demonstrating his ability to identify market opportunities and build valuable online platforms. The $10 million acquisition price provided a substantial infusion of capital, further boosting his James Altucher net worth and enabling him to pursue new investment opportunities.

Hedge Fund Management and Formula Capital

During the 2000s, Altucher ventured into the finance industry, gaining experience in hedge fund management. From 2002 to 2005, he traded for several hedge funds, honing his investment skills and developing a deeper understanding of financial markets. He subsequently became managing director of Formula Capital, a fund of hedge funds and asset management firm. In this role, he managed portfolios and crafted investment strategies, further solidifying his reputation in the financial world. The specific financial details of his compensation and performance at Formula Capital are not publicly available; however, his experience in hedge fund management likely contributed to his overall investment acumen and financial success.

“Choose Yourself” and Publishing Success

In 2013, Altucher published “Choose Yourself,” a book that resonated with readers seeking to take control of their careers and lives. The book became a bestseller, selling hundreds of thousands of copies and generating significant revenue through royalties and speaking engagements. While the precise sales figures and royalty rates remain confidential, “Choose Yourself” undoubtedly contributed substantially to his income stream. The success of “Choose Yourself” solidified his position as a thought leader in the self-help and entrepreneurship space, further enhancing his brand and opening up new opportunities for income generation.

Personal Investments and Risk Management

Altucher’s investment portfolio has spanned a variety of asset classes, including stocks, venture capital, real estate (though he prefers renting over owning), and digital assets. While the specific details of his investment holdings remain private, his public statements and interviews provide insights into his investment philosophy. He has been an early advocate of cryptocurrency, particularly Bitcoin, and has invested in numerous startups. He has also expressed skepticism towards traditional financial wisdom, questioning the conventional wisdom of homeownership and advocating for self-investment. Altucher’s willingness to take risks and embrace unconventional investment strategies has contributed to both his successes and failures, ultimately shaping his overall James Altucher net worth.

Public Speaking and Media Appearances

Altucher has been a sought-after speaker at conferences and events, sharing his insights on entrepreneurship, finance, and personal development. He has also made numerous appearances on television networks such as CNBC and CNN, as well as other podcasts and radio shows. These speaking engagements and media appearances generate income through fees and exposure, further contributing to his overall earnings.

Net Worth Fluctuations and Resilience

Altucher has openly discussed his financial ups and downs, including instances where he lost significant portions of his wealth. He has attributed these losses to poor investments, market crashes, and the inherent volatility of startups. Despite these setbacks, he has consistently demonstrated resilience, rebuilding his wealth through new ventures and diversified income streams. His willingness to share his failures and lessons learned has resonated with his audience, further enhancing his credibility and influence.

Net Worth Ranker

Net Worth Ranker