Latest Rankings

Richest Profiles

Julia Koch Net Worth

Inherited 42% stake

Net Worth

$63.0B

Koch Industries

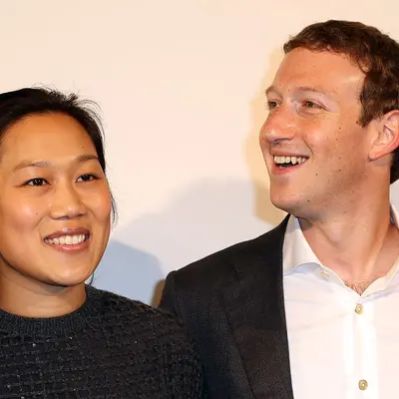

Priscilla Chan Net Worth

Co-founder

Net Worth

$30.0B

Chan Zuckerberg Initiative (CZI)

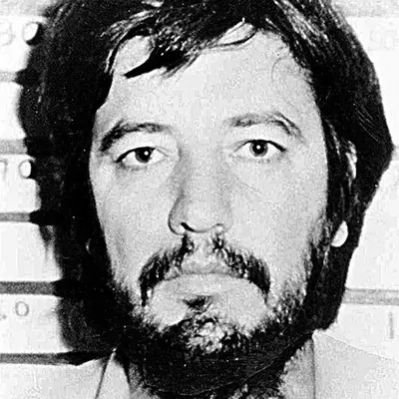

Amado Carrillo Fuentes Net Worth

Leader

Net Worth

$25.0B

Juárez Cartel

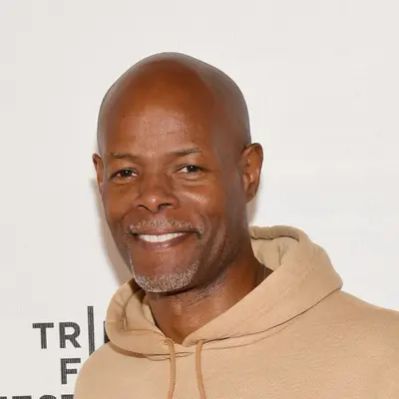

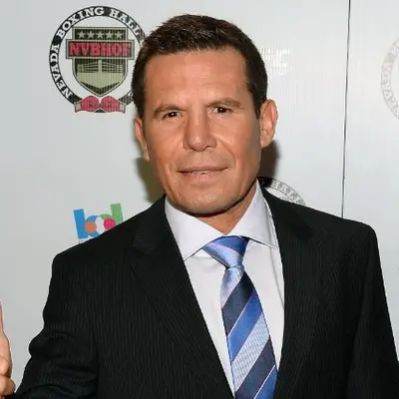

Robert Kenneth Kraft Net Worth

Chairman CEO

Net Worth

$11.0B

The Kraft Group

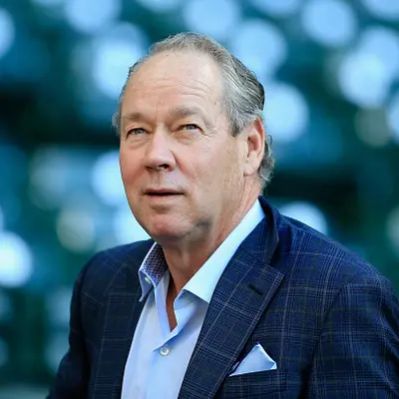

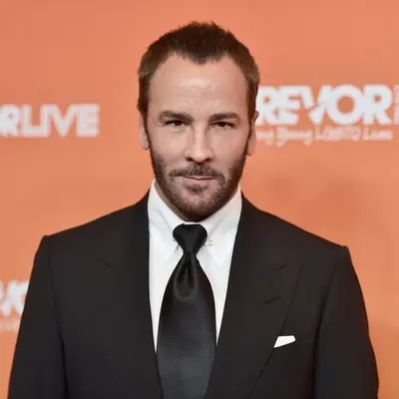

Mark Walter Net Worth

CEO

Net Worth

$10.6B

Guggenheim Partners

Anthony Malkin Net Worth

Chairman CEO

Net Worth

$10.0B

Empire State Realty Trust

Hot Rankings

Music’s Millionaires: The 10 Wealthiest Singers in 2025

1. Taylor Swift – $1.5 Billion The Queen of Pop and Profits Taylor Swift isn’t just a musical genius; she’s a financial wizard. By 2025, Swift has solidified her status as the wealthiest singer in the…

Celebrities with Jaw-Dropping Net Worths: 7 Stars That Will Astound You

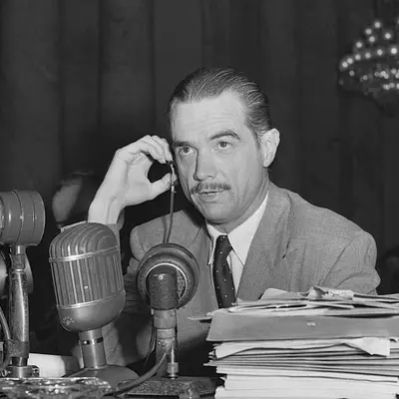

1. Lawrence Welk – $277 Million (Adjusted for Inflation) The Accordion King’s Real Estate Empire Who knew squeezing an accordion could lead to squeezing profits out of prime California real estate? La…

Inside the Wallets of Celebrities: Net Worths of 5 Lavish Livers

1. Jeff Bezos – $200 Billion The Amazon Titan and His Galactic Fortune Jeff Bezos, the founder of Amazon, is not just rich; he’s the richest person on the planet with a net worth of $200 billion. Bezo…

2025’s Richest Celebrities: Top 10 Net Worths Revealed

1. Elon Musk: The Tech Titan Reigns Supreme Net Worth: $350 Billion Elon Musk, the maverick behind Tesla, SpaceX, and a dozen other ventures, continues to dominate the wealth charts in 2025. With a ne…

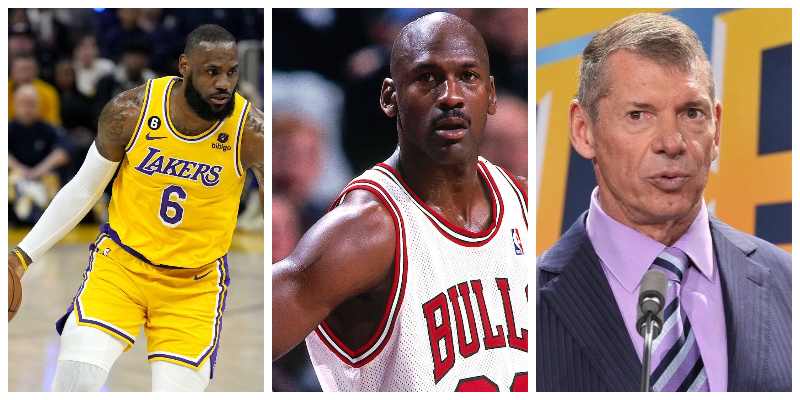

Sports Stars with Staggering Wealth: Top 5 Athlete Net Worths

1. Michael Jordan – $3.2 Billion Forget GOAT debates—MJ’s bank account just DUNKED on the entire planet! The NBA legend’s $3.2B net worth isn’t just from scoring 63 points against Larry Bird. Nope, it…

From Child Stars to Millionaires: Surprising Net Worths of 5 Beloved Childhood Idols

Miley Cyrus – Net Worth: $160 Million The Hannah Montana Sensation Miley Cyrus, the pint-sized powerhouse who stole our hearts as Hannah Montana, has grown into a full-blown superstar with a jaw-dropp…

Net Worth Ranker

Net Worth Ranker