What Is Alan Greenspan’s Net Worth?

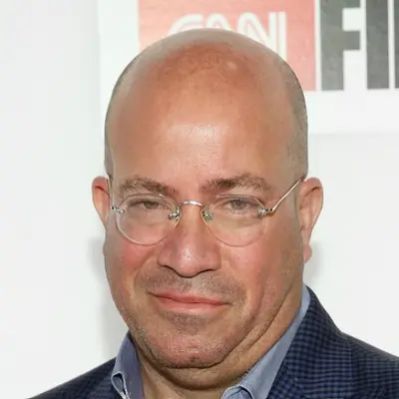

Alan Greenspan, a prominent American economist and author, boasts a net worth of approximately $20 million. This figure reflects his decades of experience in the financial sector, including his influential tenure as Chairman of the Federal Reserve of the United States. His financial portfolio is built upon his government service, private consulting work, book royalties, and strategic investments over the years.

Alan Greenspan’s Career and Earnings

Greenspan’s career trajectory is marked by several key milestones, each contributing to his financial standing. Here’s a breakdown of his notable roles and associated earnings:

Chairman of the Federal Reserve (1987-2006): Appointed by President Ronald Reagan in August 1987, Greenspan served as Chairman of the Federal Reserve for nearly two decades. During his tenure, his annual salary was $180,000. Although this salary might seem modest compared to modern executive compensation, the prestige and influence of the role provided him with invaluable experience and connections.

Greenspan Associates LLC: Following his retirement from the Federal Reserve in 2006, Greenspan established Greenspan Associates LLC, an economic consulting firm. As a private advisor, he offers his expertise to various firms, including investment banks and financial institutions. The specific earnings from this venture are not publicly disclosed, but it is a significant source of income, leveraging his extensive knowledge and network.

Early Finance Career: Before his role at the Federal Reserve, Greenspan held several key positions in the financial sector. He began working in the equity research department of investment bank Brown Brothers Harriman while attending NYU. From 1948 to 1953, he served as an analyst at The National Industrial Conference Board. In 1955, he became the president and chairman of economics consulting firm Townsend-Greenspan & Co., Inc., a position he held until 1987, with a brief interruption to serve as Chairman of the Council of Economic Advisers for Gerald Ford’s administration from 1974 to 1977. These roles provided him with a solid foundation in economic analysis and consulting, contributing to his overall financial expertise.

Government Service: Prior to his role at the Federal Reserve, Greenspan served as Chairman of the Council of Economic Advisers under President Gerald Ford from 1974 to 1977. While specific salary details for this position are not outlined, serving in such a high-profile role enhanced his reputation and provided him with invaluable experience in economic policy.

Financial Disclosures and Assets

While serving as Chairman of the Federal Reserve, Alan Greenspan was required to make financial disclosures. According to his last financial disclosure statement submitted in 2004, Alan controlled assets valued between $3 and $6.5 million at that point. At the time, his assets were primarily invested in short-term Treasury Bills, reflecting a conservative approach to managing his finances while holding such a significant public office. At the same time, his wife NBC News correspondent Andrea Mitchell listed her separate assets as being worth $1.3 to $3 million. These assets provide insight into his financial management during his tenure as Fed Chairman.

Additional Income Streams and Investments

In addition to his salary and consulting income, Greenspan has augmented his net worth through various other avenues:

Book Royalties: Greenspan is the author of several books, including “The Age of Turbulence: Adventures in a New World” (2007) and “Capitalism in America: A History” (2018). The royalties from these publications have contributed to his overall income. While specific royalty figures are not publicly available, best-selling books can generate substantial income for their authors.

Consulting and Advisory Roles: Beyond Greenspan Associates LLC, Alan has engaged in various consulting and advisory roles for financial institutions. In 2007, Pacific Investment Management Company (PIMCO) hired him as a special consultant. He also began advising investment bankers and clients at Deutsche Bank. In 2008, he joined the Paulson & Co. hedge fund as an advisor. These engagements likely involve significant fees, reflecting his expertise and the high demand for his insights.

Speaking Engagements: Greenspan is a sought-after speaker at economic conferences and corporate events. Speaking fees for prominent economists can range from tens of thousands to hundreds of thousands of dollars per engagement, depending on the event’s prestige and the length of the presentation. While the exact figures for Greenspan’s speaking engagements are not public, it’s a substantial part of his income.

Early Life and Education

Alan Greenspan was born on March 6, 1926, in New York City. His parents, Rose and Herbert (a market analyst and stockbroker), were of Hungarian-Jewish and Romanian-Jewish descent, respectively. Rose and Herbert divorced when Alan was young, and he was raised by his mother in his grandparents’ home. Greenspan graduated from George Washington High School in 1943 and went on to attend the Juilliard School, where he studied clarinet. He stayed at Juilliard until 1944, then attended the Stern School of Business at New York University, graduating summa cum laude with a Bachelor of Arts degree in economics in 1948. Alan earned a Master of Arts degree in economics two years later and briefly studied advanced economics at Columbia University but dropped out to focus on his work at Townsend-Greenspan & Company. He earned a Ph.D. in economics from NYU in 1977. These achievements in education laid the groundwork for his success in the financial world.

Federal Reserve Tenure: Key Decisions and Impact

Greenspan’s tenure at the Federal Reserve was marked by significant economic events and policy decisions. Here are some key highlights:

Nomination and Reappointments: Greenspan was nominated by President Ronald Reagan in August 1987 to succeed Paul Volcker as chairman of the Board of Governors of the Federal Reserve. He was reappointed by Presidents George H. W. Bush, Bill Clinton, and George W. Bush, making his tenure the second-longest in the position’s history.

Clinton’s Deficit Reduction Program: Greenspan supported President Bill Clinton’s deficit reduction program in 1993, which aimed to balance the federal budget and promote economic growth. This support was crucial in gaining bipartisan consensus for the program.

Mexican Peso Crisis (1994–1995): Greenspan was involved in the country’s bailout of Mexico during the Mexican peso crisis, which threatened to destabilize the Mexican economy. His involvement underscored the Federal Reserve’s role in international financial stability.

Interest Rate Hikes in 2000: Greenspan raised interest rates multiple times in 2000, a move that some analysts believe contributed to the bursting of the dot-com bubble. These decisions were aimed at curbing inflation and preventing the economy from overheating.

Support for George W. Bush’s Tax Cut: Greenspan showed support for George W. Bush’s proposed tax decrease in 2001, arguing that it would stimulate economic growth. He also suggested that the administration should remove Saddam Hussein from power in order to “secure world oil supplies.”

Post-Federal Reserve Activities

After retiring from the Federal Reserve in January 2006, Greenspan remained active in the economic sphere. He formed Greenspan Associates LLC, providing consulting services to various clients. He also took an honorary position at the United Kingdom’s HM Treasury. In 2007, he predicted a possible U.S. recession, causing the Dow Jones Industrial Average to drop 416 points the next day. These post-retirement activities demonstrate his continued influence and relevance in the global economy.

Personal Life and Relationships

Alan Greenspan’s personal life includes notable relationships and marriages. He married artist Joan Mitchell in 1952, and the couple annulled their marriage the following year. He went on to wed journalist Andrea Mitchell on April 6, 1997, in a ceremony officiated by Supreme Court Justice Ruth Bader Ginsburg. Greenberg also had a relationship with Barbara Walters in the mid-1970s. These relationships provide additional context to his personal life.

Awards and Honors

Alan Greenspan has received numerous awards and honors throughout his career, reflecting his contributions to economics and public service:

Presidential Medal of Freedom (2005): George W. Bush presented him with the Presidential Medal of Freedom in November 2005, the highest civilian honor in the United States.

Commander of the French Legion d’honneur (2000): This prestigious French award recognizes his contributions to international relations.

Knight Commander of the British Empire (2002): This British honor acknowledges his significant contributions to economic policy.

Department of Defense Medal for Distinguished Public Service (2006): Awarded for his service to the Department of Defense.

Dwight D. Eisenhower Medal for Leadership and Service (2004): Presented by the Eisenhower Fellowships.

Harry S. Truman Medal for Economic Policy (2005): He was the first person to receive this award.

Honorary Doctor of Commercial Science degree from NYU (2005): This honorary degree recognizes his contributions to the field of commerce.

U.S. Senator John Heinz Award for Greatest Public Service (1976): Awarded for his public service.

Thomas Jefferson Foundation Medal in Citizen Leadership (2007): Presented for his leadership.

Eugene J. Keogh Award for Distinguished Public Service (2012): Awarded for his distinguished public service.

Fellow of the American Statistical Association (1989): The ASA’s highest honorary level of membership.

These awards highlight the significant impact and recognition Alan Greenspan has received throughout his career.

Analysis of Alan Greenspan’s Net Worth

Alan Greenspan’s $20 million net worth is a culmination of his government salary, consulting income, book royalties, and strategic investments. His long and influential career as an economist and public servant has provided him with significant financial opportunities. While the exact figures for his various income streams are not always publicly available, the available information provides a comprehensive picture of his financial standing. Alan Greenspan has built his net worth steadily over decades of dedicated service and expertise.

Net Worth Ranker

Net Worth Ranker