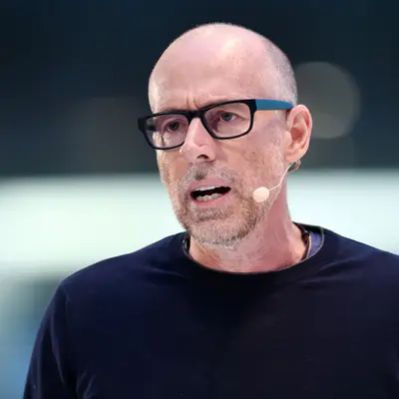

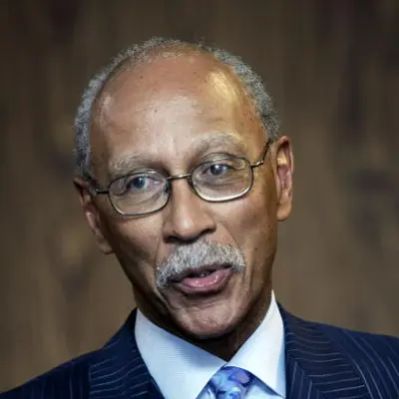

What Is Bruce Ratner Net Worth?

Bruce Ratner, an American real estate developer, has accumulated a considerable net worth of $400 million. This valuation reflects his decades of work in transforming New York City’s landscape, particularly in Brooklyn, through ambitious development projects and his foray into sports franchise ownership.

Early Life and Career Beginnings

Born on January 23, 1945, in Cleveland, Ohio, Bruce Ratner hails from a Jewish family deeply entrenched in the real estate business. His upbringing was marked by exposure to the intricacies of property development through his brother and uncles, who were successful real estate developers in the Cleveland area. Ratner pursued higher education at Harvard University, where he earned his bachelor’s degree in 1967. He continued his academic journey at Columbia Law School, graduating in 1970. Rather than immediately joining the family business, Ratner initially ventured into public service, signaling an early commitment to urban affairs and community enhancement.

In the 1970s, Bruce Ratner served as New York City’s Consumer Affairs Commissioner under Mayor Ed Koch. This role provided him with invaluable insights into city governance and public policy. His experience within city operations allowed him to foster relationships that later proved essential in his real estate endeavors. These years in public service honed his understanding of urban dynamics, setting the stage for his transition into private development.

Founding Forest City Ratner Companies

In 1985, Bruce Ratner founded Forest City Ratner Companies, a subsidiary of his family’s Forest City Enterprises, marking his formal entry into the world of private development. This pivotal moment set the stage for Ratner’s rise as one of New York City’s most influential and, at times, controversial real estate developers.

One of Bruce Ratner’s early and significant projects was the development of MetroTech Center in Downtown Brooklyn. This $1 billion office complex played a crucial role in retaining back-office operations for major financial institutions in New York City. Completed in the 1990s, MetroTech Center became a model for urban commercial development, showcasing Ratner’s capacity to execute large-scale projects in complex urban settings. This success paved the way for other major developments, including the Atlantic Terminal Mall and Atlantic Center, further solidifying his reputation as a transformative figure in Brooklyn’s development.

Acquisition of the New Jersey Nets and the Barclays Center

Bruce Ratner’s acquisition of the New Jersey Nets in 2004 for $300 million signaled his entry into professional sports ownership. His vision extended beyond simply owning a sports team; he aimed to relocate the Nets to Brooklyn as part of a larger development initiative. This ambitious plan faced numerous legal challenges and community opposition, but Ratner remained steadfast in his commitment.

After years of navigating legal hurdles and community concerns, the Barclays Center finally opened its doors in 2012. This event marked the return of major professional sports to Brooklyn for the first time since the Dodgers left in 1957. The arena became the centerpiece of Ratner’s Atlantic Yards development (later renamed Pacific Park) and has since hosted countless high-profile sporting events, concerts, and other entertainment events, significantly boosting Brooklyn’s profile as a major entertainment hub.

The Atlantic Yards project, spearheaded by Bruce Ratner, faced significant controversy. Critics argued that the use of eminent domain displaced residents and small businesses, while supporters lauded the project for its urban renewal and economic development potential. The project was subject to numerous lawsuits and community protests, but it ultimately moved forward, albeit with adjustments to the original plan. The debates surrounding the Atlantic Yards project underscore the complex interplay between private developers, urban communities, and public policy.

Later Career and Transition

In 2013, Bruce Ratner stepped down as CEO of Forest City Ratner Companies but remained as executive chairman. He later sold his stake in the Brooklyn Nets and the Barclays Center in 2016 to Mikhail Prokhorov, marking the end of his involvement in sports ownership. Under his leadership, Forest City Ratner Companies developed over 11 million square feet of property in the New York metropolitan area, significantly impacting the region’s real estate landscape and economic development. Bruce Ratner’s contributions have left an indelible mark on New York City, shaping its urban environment and influencing debates about urban development and community engagement.

Net Worth Ranker

Net Worth Ranker