What Is Dan Snyder’s Net Worth?

Dan Snyder, an American advertising executive and sports team owner, boasts a net worth of $5 billion as of today, April 9, 2025. His wealth is primarily derived from his successful career in advertising and his ownership of the Washington Commanders (formerly the Redskins) football team. Snyder purchased the team in 1999 for $800 million, a transaction financed mostly through loans. He later sold the Commanders in May 2023 for $6 billion to a group of investors led by Josh Harris.

Dan Snyder’s Business Ventures and Financial Milestones

Snyder’s entrepreneurial journey began early. At the age of 20, he managed a business leasing jets for college students to travel to Florida and the Caribbean during spring break. Following this, he launched a college magazine called Campus USA, funded by Mortimer Zuckerman and Fred Drasner. Although Campus USA closed after two years due to advertising challenges, it marked an early foray into the business world.

In 1988, Dan Snyder and his sister Michele founded Snyder Communications, a wallboard advertising company. Initially focusing on wallboards in colleges and doctors’ offices, the company expanded into direct marketing, database marketing, and call centers. By 1998, Snyder Communications employed over 12,000 individuals and generated $1 billion in annual revenue. In 2000, he sold Snyder Communications to the French marketing and public relations group Havas for $2 billion, personally netting $300 million from the deal.

In 1999, Snyder acquired the Washington Redskins (now the Washington Commanders) and Jack Kent Cooke Stadium for $800 million. To manage the debt incurred from the purchase, Snyder sold portions of his ownership to Robert Rothman, Dwight Schar, and Frederick W. Smith. After a period of litigation, Snyder bought back the remaining ownership stake after receiving a $400 million debt waiver. The Commanders were eventually sold in May 2023 for $6 billion.

Through his private equity firm RedZone Capital, Snyder acquired a 12% stake in Six Flags in 2005 and became chairman of the board. After Six Flags filed for Chapter 11 bankruptcy protection in 2009, Snyder was removed from his position. RedZone Capital also acquired the restaurant chain Johnny Rockets, which he later sold in 2013 to Sun Capital Partners. Additionally, Snyder owned Dick Clark Productions from 2007 to 2012.

Controversies and Financial Implications During Snyder’s Ownership

During his tenure as owner of the Washington Redskins/Commanders, Snyder faced numerous controversies. One significant issue was the team’s name, which he initially resisted changing despite widespread criticism. The name was eventually changed to the Washington Commanders in 2022 after pressure from shareholders and investors. Furthermore, allegations of a toxic workplace culture, including sexual harassment of female employees, led to a $10 million fine from the NFL. It was also revealed that Snyder had underreported ticket sales to the NFL and the IRS and manipulated prices through third-party vendors. These controversies impacted the team’s financial standing and reputation.

Dan Snyder’s Real Estate Portfolio

Dan Snyder’s real estate holdings include several high-value properties. In July 2001, he purchased a 30,000 square foot mansion in Potomac, Maryland, from the King of Jordan and Queen Noor for $8.64 million. The 15-acre property is located at an undisclosed address but is known for its size and luxurious amenities. This purchase occurred shortly after selling his business for $2 billion and acquiring the Washington Redskins.

In November 2022, Snyder acquired a 16.5-acre property in Alexandria, Virginia, for $48 million. This property is historically part of George Washington’s 1,800-acre River Farm estate. The exact address is not publicly available, but the purchase underscores Snyder’s investment in high-end real estate. Snyder and his wife also own a 12,000 square foot mansion in Aspen, Colorado, and a mansion in London; however, specifics about their locations and values are not publicly disclosed.

Yacht Acquisitions and Specifications

Dan Snyder has owned multiple luxury yachts. In 2011, he acquired a 224-foot yacht named Lady Anne for $70 million. This yacht features five decks, accommodating 16 guests and an 18-member staff. The master suite includes top-of-the-line Thassos marble. Onboard amenities include a cocktail bar, lounge, dining areas, library, theater screening room, and a full gymnasium. The outdoor decks offer an open-air bar, lounge, and dining area.

In January 2019, Snyder purchased a 305-foot yacht called Lady S for $100 million. The Lady S includes a 12-seat IMAX movie theater, a helipad, and facilities for golf, basketball, and volleyball. The yacht is powered by twin diesel engines, each producing 2,375 HP, allowing a top speed of 17.4 knots and a range of 5,500 nautical miles on a single tank. These yachts represent a significant investment and highlight Snyder’s affinity for luxury assets.

Personal Life and Family

Dan Snyder married Tanya Ivey, a former fashion model, in 1994. The couple has three children and resides in Alexandria, Virginia. Tanya Ivey became co-CEO of the Washington Commanders in 2021, highlighting her involvement in Snyder’s business ventures. Specifics about their daily routines or personal habits are not publicly available, but their ownership of high-value assets such as luxury yachts and real estate reflects a high-end lifestyle.

Details on Snyder Communications Sale

In 2000, Dan Snyder sold Snyder Communications to Havas, a French marketing and public relations group, for $2 billion. This sale marked a significant milestone in Snyder’s career, resulting in a personal windfall of $300 million. At the time of the acquisition, Snyder Communications was a leading provider of direct marketing, database marketing, and call center services. The company’s success was built on a strategy of rapid expansion through a series of acquisitions. By the time of its sale, Snyder Communications had over 12,000 employees and annual revenues of $1 billion. The acquisition allowed Havas to strengthen its position in the U.S. market and expand its service offerings. The specific terms of the sale, beyond the headline price, are not publicly available.

Specifics on the Washington Commanders Sale

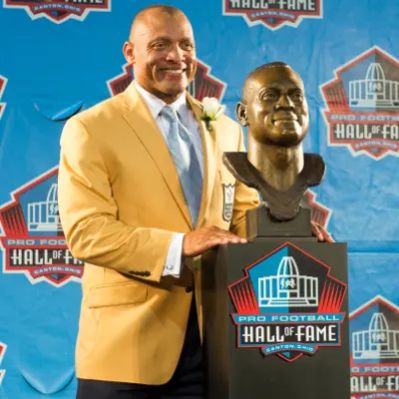

In May 2023, Dan Snyder sold the Washington Commanders to a group of investors led by Josh Harris for $6 billion. This sale set a record for the most expensive North American sports team sale ever. The Harris group includes several prominent investors, such as Mitchell Rales and Magic Johnson. The transaction was subject to approval by the NFL owners, which it received. The sale ended Snyder’s controversial 24-year ownership of the team. Specific details of the sale agreement, such as the exact breakdown of the investment from each member of the Harris group, are not publicly available. The $6 billion sale price represents a substantial return on Snyder’s initial investment of $800 million in 1999.

Insights into Six Flags Investment

In 2005, Dan Snyder, through his private equity firm RedZone Capital, purchased a 12% stake in Six Flags. Following this investment, Snyder became chairman of the board of the company. Snyder’s involvement with Six Flags was aimed at revitalizing the theme park chain and improving its financial performance. However, Six Flags faced financial challenges and filed for Chapter 11 bankruptcy protection in 2009. As a result of the bankruptcy proceedings, Snyder was removed from his position as chairman of the board. Specific details regarding the financial performance of Six Flags during Snyder’s involvement and the specific reasons for his removal from the board are not publicly available. Snyder’s investment in Six Flags demonstrates his interest in diverse business ventures beyond sports and advertising.

Details Regarding the Potomac Mansion Purchase

In July 2001, Dan Snyder purchased a 15-acre estate in Potomac, Maryland, for $8.64 million. The seller of the property was the King of Jordan and his wife, Queen Noor. The estate features a 30,000-square-foot mansion, making it one of the largest and most luxurious residences in the area. The property includes numerous amenities, such as a swimming pool, tennis court, and extensive landscaping. The exact address of the property is not publicly disclosed, but it is known to be located in a prestigious area of Potomac. The purchase of this estate reflects Snyder’s affluence and his preference for high-end real estate. The mansion served as Snyder’s primary residence for many years. Renovations and improvements were made to the property during his ownership. The estate is a significant asset in Snyder’s real estate portfolio.

Information on the Yacht “Lady S”

Dan Snyder’s yacht, “Lady S,” is a 305-foot superyacht built by Feadship. He acquired it in January 2019 for $100 million. The yacht is known for its luxurious amenities, including a 12-seat IMAX movie theater. There is also a helipad that allows for convenient arrival and departure. In addition, the yacht includes facilities for various sports activities, such as golf, basketball, and volleyball. “Lady S” is powered by twin diesel engines. This gives it a top speed of 17.4 knots. It also allows it to cover 5,500 nautical miles on a single tank. The yacht can accommodate multiple guests. There are separate areas for an extensive staff. The interior of “Lady S” is designed with high-end materials and finishes. The amenities create a comfortable and elegant atmosphere. This luxurious yacht is a substantial asset in Snyder’s investment portfolio. It reflects his penchant for opulent acquisitions.

RedZone Capital and Johnny Rockets

Through his private equity firm, RedZone Capital, Dan Snyder acquired the restaurant chain Johnny Rockets. The specific date of acquisition is not publicly available. However, Snyder owned Johnny Rockets for several years. During his ownership, RedZone Capital focused on expanding the restaurant chain and improving its operations. In 2013, Snyder sold Johnny Rockets to Sun Capital Partners. The terms of the sale, including the sale price, are not publicly disclosed. Johnny Rockets, known for its retro diner theme and classic American fare, was a part of Snyder’s portfolio of diverse investments. Snyder’s involvement with Johnny Rockets reflects his interest in the restaurant and hospitality industries. Further details about RedZone Capital’s strategies and performance during its ownership of Johnny Rockets are not publicly accessible.

Other Business Ventures and Investments

Besides Snyder Communications, the Washington Commanders, Six Flags, and Johnny Rockets, Dan Snyder has been involved in several other business ventures. From 2007 to 2012, he owned Dick Clark Productions, a company known for producing various entertainment shows and events. The financial details of this acquisition and eventual sale are not publicly available. Snyder’s diverse investment portfolio highlights his entrepreneurial spirit. It also shows his willingness to engage in various industries. Detailed information about the performance and outcomes of these other ventures is limited in publicly available records. His involvement in these ventures demonstrates his breadth of business interests. It also underscores his activity in investment and management.

Details of Environmental Controversies

In 2004, Dan Snyder became embroiled in an environmental controversy. He made an agreement with the National Park Service (NPS) to cut down old-growth trees on national parkland behind his house. This was done to improve his view of the Potomac River. This action led to numerous complaints from neighbors. An NPS ranger investigation followed, along with a whistleblower complaint. The specifics of the agreement with the NPS and the exact number of trees cut down are not publicly available. However, the incident caused significant public backlash. It led to criticism of Snyder’s environmental disregard. The controversy highlights the tension between private interests and environmental protection. It also underscores the scrutiny Snyder faced in his various endeavors. The precise legal and financial repercussions of this incident are not fully detailed in publicly accessible records.

Details About Dan Snyder’s Early Life

Dan Snyder was born on November 23, 1964, in Silver Spring, Maryland. His parents are Gerald and Arlette Snyder. During his childhood, he attended Hillandale Elementary School. At the age of 12, Snyder moved to Henley-on-Thames in England. There, he attended a private school. He returned to the United States two years later. He then lived with his grandmother in New York City. After that, he moved back to Maryland to attend Charles W. Woodward High School. Snyder enrolled at the University of Maryland, College Park, for his higher education. However, he ultimately dropped out. The specific reasons for his dropping out are not publicly available. The details of his early life provide a foundation for understanding his entrepreneurial journey. They also highlight the diverse experiences that shaped his business acumen. Additional information about his academic performance or extracurricular activities during these years is not detailed in publicly accessible records.

Net Worth Ranker

Net Worth Ranker