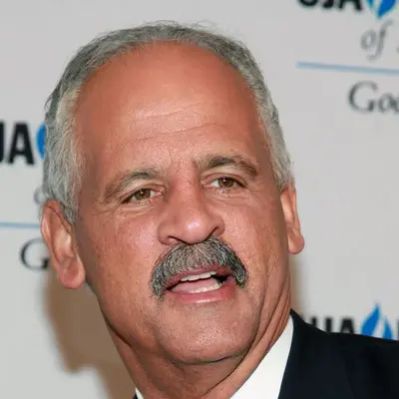

What Is Dave Ramsey’s Net Worth?

Dave Ramsey, a prominent American author, financial expert, entrepreneur, and radio host, has built a considerable fortune over his career. As of 2025, Dave Ramsey’s net worth is estimated to be around $200 million. A significant portion, approximately $150 million, is attributed to his extensive real estate portfolio. Ramsey’s influence extends through his nationally syndicated radio program, “The Ramsey Show,” broadcast across over 500 radio stations in the United States and Canada. He is also the author of several best-selling books, including “The Total Money Makeover,” which provide financial guidance based on Christian principles.

Early Life and Career Beginnings

Born on September 3, 1960, in Antioch, Tennessee, Dave Ramsey grew up in a family involved in real estate development. He attended Antioch High School, where he was a member of the ice hockey team. Ramsey pursued higher education at the University of Tennessee in Knoxville, focusing on finance and real estate. While studying, he began his career in real estate sales. By 1986, at the age of 26, Ramsey had amassed a real estate portfolio valued at more than $4 million through aggressive leveraging. However, his financial success was short-lived. In 1987, the enactment of the Competitive Equality Banking Act led to the recall of his $1.2 million in loans and credit lines. Unable to meet these obligations, Ramsey declared bankruptcy in 1988. This experience became a pivotal point in his life, leading him to develop his financial principles and teachings.

Radio and Financial Teachings

In 1992, Dave Ramsey started his radio career as one of the rotating hosts of “The Money Game” on a Nashville radio station. He shared the hosting duties with Hal Wilson and Roy Matlock. Ramsey utilized this platform to discuss bankruptcy and strategies for debt reduction. Eventually, he became the sole host of the show, which was renamed “The Dave Ramsey Show” in 1996, later simplified to “The Ramsey Show.” This nationally syndicated program, spanning three hours, features Ramsey taking live calls from listeners seeking financial advice, often incorporating Christian perspectives. From 2007 to 2010, he also hosted a show on the Fox Business Network, further expanding his reach. Ramsey’s financial advice emphasizes debt reduction through the debt snowball method, prioritizing the payoff of debts with the lowest balances first. He strongly advises against using credit cards, advocating for a cash-based system using envelopes for various expenses. His teachings have faced criticism for not fully addressing income disparities and potential financial emergencies, and his investment advice has been critiqued for its heavy reliance on stock investments.

Legal Challenges and Controversies

In June 2023, Dave Ramsey was named in a $150 million lawsuit filed by listeners of his show who claimed they were defrauded by Timeshare Exit Team, an advertiser on his program. Timeshare Exit Team, which later operated as Reed Hein & Associates, ceased operations in 2021 after agreeing to a $2.6 million settlement regarding deceptive practices. Ramsey’s financial counseling company, Ramsey Solutions, has also faced scrutiny for its labor practices. In 2020, Julie Anne Stamps, an employee, was allegedly told that her employment would be terminated after she came out as lesbian, citing company policy. The same year, Caitlin O’Connor, a former employee, filed a federal lawsuit alleging that she was fired for being pregnant out of wedlock. Recordings later surfaced of Ramsey seemingly mocking employees regarding company policies. Furthermore, Ramsey Solutions faced criticism for its handling of COVID-19 safety protocols. The company reportedly remained open even after employees tested positive for the virus and continued to hold large gatherings, disregarding safety measures. A former employee filed a federal lawsuit in 2021, alleging that he was terminated for taking basic precautions against the virus. These incidents have raised questions about the company’s internal policies and practices.

Real Estate Investments and Personal Life

Dave Ramsey and his wife, Sharon, have three children: Denise, Rachel, and Daniel, all of whom are employed by Ramsey Solutions. In 2014, Dave and Rachel co-authored the book “Smart Money, Smart Kids.” Previously, the Ramseys resided in a custom-built home on five acres in Franklin, Tennessee. They acquired the land in 2008 for $1.5 million, paying entirely in cash without a mortgage. The construction of their 13,545-square-foot mansion was completed a year later. Their neighbor was singer LeAnn Rimes, who sold her custom-built 13,000-square-foot mansion in 2012 for $4.1 million. In February 2021, the Ramseys listed their mansion for sale at $15.45 million and ultimately sold it in August 2021 for $10.2 million. That same month, they purchased a 7,000-square-foot mansion in College Grove, Tennessee, for $3.75 million. These real estate transactions highlight Ramsey’s investment strategies and personal financial decisions.

Detailed Financial Breakdown

Dave Ramsey’s $200 million net worth is a culmination of various assets and income streams. His real estate portfolio accounts for $150 million, reflecting his long-term investments in properties. The remaining $50 million is derived from Ramsey Solutions, his financial counseling company, book sales, radio show revenue, speaking engagements, and other ventures. Ramsey Solutions, in particular, generates significant revenue through its various programs, products, and services aimed at providing financial education and counseling. Ramsey’s books, including “The Total Money Makeover,” have sold millions of copies, contributing substantially to his income. His radio show, “The Ramsey Show,” generates revenue through advertising and syndication agreements. Speaking engagements and personal appearances also contribute to his overall net worth. While precise figures for each income stream are not publicly available, the estimated breakdown provides a comprehensive overview of Dave Ramsey’s financial standing.

Philanthropic Activities and Public Image

While Dave Ramsey is known for his financial advice and business ventures, he is also involved in philanthropic activities. Through Ramsey Solutions, he supports various charitable organizations and initiatives. Details about specific donations and contributions are not widely publicized, but his commitment to giving back to the community is evident through his company’s involvement in various causes. Ramsey’s public image is that of a financially conservative and devout Christian. His teachings often incorporate biblical principles and emphasize the importance of financial stewardship. He is a vocal advocate for debt reduction and responsible financial management. His straight-talking style and no-nonsense approach have resonated with millions of listeners and readers. While his views have faced criticism, he remains a prominent figure in the financial advice industry.

Ramsey’s Financial Principles

Dave Ramsey’s financial principles are rooted in the idea of avoiding debt and building wealth through disciplined savings and investments. He advocates for a “snowball” approach to debt repayment, where individuals focus on paying off their smallest debts first to gain momentum and motivation. He is a strong proponent of using cash instead of credit cards, believing that this helps individuals stay within their budgets and avoid unnecessary debt. Ramsey also emphasizes the importance of saving for emergencies and investing for the long term. He recommends investing in diversified mutual funds and avoiding speculative investments. His financial advice is geared towards helping individuals achieve financial freedom and security through responsible financial habits.

Impact and Legacy

Dave Ramsey has had a significant impact on the financial lives of millions of people. His radio show, books, and programs have provided guidance and support to those seeking to improve their financial situations. He has empowered individuals to take control of their finances, reduce debt, and build wealth. Ramsey’s teachings have resonated with a wide audience, particularly those who share his Christian values. His no-nonsense approach and practical advice have made him a trusted voice in the financial advice industry. While his views have faced criticism, his impact on personal finance education is undeniable. His legacy will continue to shape the way people think about and manage their money for years to come.

Net Worth Ranker

Net Worth Ranker