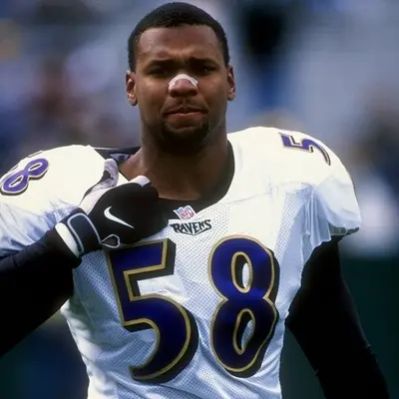

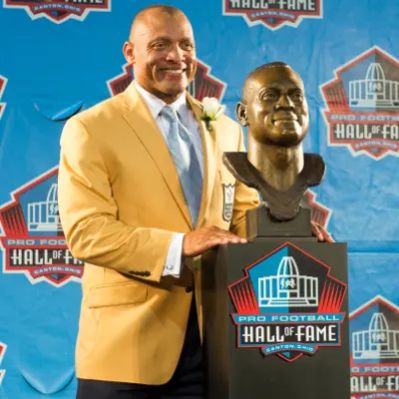

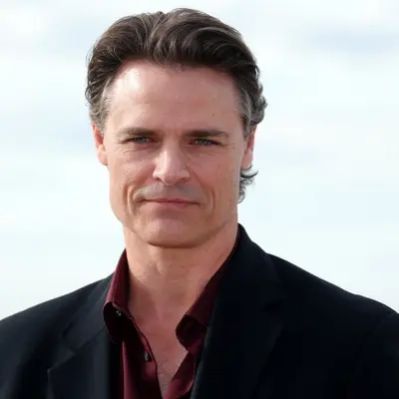

What Is Drew Bledsoe’s Net Worth?

Drew Bledsoe, a former professional American football quarterback, has accumulated a substantial net worth of $30 million. This financial standing is primarily the result of his 14 seasons in the National Football League (NFL), significant earnings from endorsements, and astute investments made post-retirement, including his foray into the wine industry.

Early Career and NFL Earnings

Bledsoe’s professional football journey began after a successful collegiate career at Washington State University. He was the first overall pick in the 1993 NFL Draft, selected by the New England Patriots. During his time in the NFL, Bledsoe played for the Patriots, Buffalo Bills, and Dallas Cowboys, earning an estimated $80 million in salary alone. One notable contract was the 10-year, $103 million deal he signed with the Patriots in 2001, which was a record at the time. However, Bledsoe’s tenure with the Patriots took an unexpected turn with the emergence of Tom Brady, altering his career trajectory but not diminishing his overall earnings.

Post-NFL Ventures: Doubleback Winery

Following his retirement from the NFL in 2007, Drew Bledsoe embarked on a new venture by co-founding Doubleback Winery in Walla Walla, Washington. This winery focuses on producing premium Cabernet Sauvignon and Chardonnay. Initially partnering with his friend Chris Figgins, Bledsoe later saw Figgins’ interest transfer to Josh McDaniels. In a significant expansion, Bledsoe and McDaniels acquired an 80-acre property in the Eola-Amity Hills AVA of Oregon, further solidifying their presence in the wine industry. While the exact financial details of Doubleback Winery are not publicly available, the winery’s success has undoubtedly contributed to Bledsoe’s net worth. The average price of Doubleback Cabernet Sauvignon is around $150-$200 per bottle, indicative of the high-end market they cater to. Bledsoe’s engagement in this venture showcases his entrepreneurial spirit and ability to transition from a successful sports career to a thriving business.

Real Estate Investments: Bend, Oregon Mansion

In 2004, Drew Bledsoe and his wife Maura invested in real estate by purchasing a 10-acre property in the Highlands at Broken Top, a gated community in Bend, Oregon, for $750,000. On this property, they constructed a 15,000-square-foot mansion featuring seven bedrooms and offering views of the Cascade Mountains. The Bledsoes listed the property for $9.5 million in 2014. They eventually sold it for $5.6 million in June 2020. While the sale price was lower than the initial listing, the investment still contributed to Bledsoe’s overall financial portfolio. Given the subsequent real estate market boom during the COVID-19 pandemic, it is speculated that the property’s value could have reached as high as $15 million based on comparable sales, had they held onto it. Bledsoe’s real estate decisions reflect his strategic approach to managing his assets and diversifying his investments.

NFL Career Highlights and Earnings Breakdown

Bledsoe’s NFL career was marked by several notable achievements. He was a four-time Pro Bowl selection (1994, 1996, 1997, and 2002) and led the New England Patriots to Super Bowl XXXI in 1997. In 1998, he achieved a unique feat by completing game-winning touchdown passes in the final 30 seconds of two consecutive games. Bledsoe’s highest single-season earnings came in 2001 when he signed a 10-year, $103 million contract with the Patriots. Although his role with the Patriots changed due to injury and the rise of Tom Brady, Bledsoe still earned a substantial portion of this contract. Over his 14-year NFL career, his earnings averaged around $5.7 million per year, contributing significantly to his current net worth.

Detailed Look at NFL Contracts and Payments

Examining Bledsoe’s contract details provides further insight into his financial accumulation. His 2001 contract with the Patriots, valued at $103 million over 10 years, included a significant signing bonus and various performance-based incentives. While the exact figures for the signing bonus are not publicly available, it likely constituted a substantial upfront payment. After being traded to the Buffalo Bills in 2002, Bledsoe continued to earn a high salary, passing for 4,359 yards and 24 touchdowns in his first season. During his tenure with the Dallas Cowboys, Bledsoe signed a contract that provided a base salary of approximately $3 million per year, supplemented by potential bonuses. These contracts, combined with endorsements and other income sources, solidified Bledsoe’s financial stability and contributed to his $30 million net worth.

Personal Life and Current Ventures

Beyond his professional career and entrepreneurial pursuits, Drew Bledsoe is married to Maura, and they have four children: Stuart, Henry, John, and Healy. He coached his sons Stuart and John at Summit High School in Bend, Oregon, showcasing his dedication to family and community. Bledsoe’s current ventures, particularly Doubleback Winery, reflect his commitment to building a long-term legacy beyond football. The winery’s focus on quality and sustainability aligns with Bledsoe’s values, and its success has become a significant component of his overall financial portfolio. While specific details of other potential investments remain private, Bledsoe’s track record indicates a balanced approach to wealth management, contributing to his maintained net worth of $30 million.

Financial Strategies and Wealth Preservation

Drew Bledsoe’s financial success can be attributed to a combination of high earnings during his NFL career and strategic post-retirement investments. His decision to enter the wine industry with Doubleback Winery showcases his ability to identify and capitalize on new opportunities. Bledsoe’s real estate investments, while not always resulting in immediate gains, demonstrate a long-term approach to wealth preservation. Furthermore, Bledsoe likely benefited from sound financial advice and planning throughout his career, which enabled him to manage his earnings effectively and mitigate potential risks. His continued engagement with his business ventures ensures a steady income stream, complementing his existing assets and contributing to his sustained financial stability.

Net Worth Ranker

Net Worth Ranker