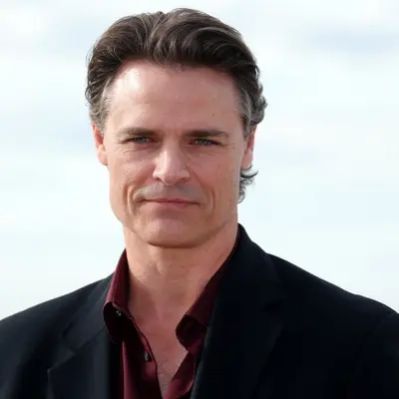

What Is Edgar Bronfman Jr.’s Net Worth?

Edgar Bronfman Jr., an American media executive and heir, has an estimated net worth of $500 million. This substantial fortune reflects his diverse career across various sectors, including entertainment, investment, and media leadership. His financial standing is primarily built upon his roles as a managing partner at Accretive LLC, chairman of FuboTV, and chairman of Endeavor, along with his previous tenures as CEO of Warner Music Group and the Seagram Company.

Early Life and Family Background

Born on May 16, 1955, in New York City, Edgar Bronfman Jr. is the son of Ann and Edgar Bronfman Sr., the billionaire businessman who led the World Jewish Congress. Edgar Sr.’s net worth at the time of his death in 2013 was approximately $2.5 billion. The Bronfman family’s wealth originated from the Seagram Company, a whisky distilling empire built by his paternal grandfather, Samuel Bronfman, a prominent figure in the Canadian Jewish community. His maternal grandmother, Frances Lehman, was a member of the Lehman banking family, further intertwining his lineage with significant financial dynasties. Bronfman Jr. grew up as one of five children, shaped by the considerable affluence and influence of his family.

Career Beginnings in Entertainment

In the 1970s, Edgar Bronfman Jr. began his career in the entertainment industry, initially focusing on producing films and Broadway shows. One of his earliest ventures was producing “The Blockhouse,” a film released in 1973. He then partnered with Steve Sheppard to form Sagittarius Productions, followed by establishing Efer Productions, which secured a three-year production contract with Universal Studios. Through Efer Productions, Bronfman produced “The Border” in 1982, directed by Tony Richardson and starring Jack Nicholson. This period marked his initial foray into the creative side of the entertainment business. Bronfman also explored songwriting, collaborating with Bruce Roberts under the pseudonyms Junior Miles and Sam Roman. Their collaborations resulted in songs like “Whisper in the Dark” for Dionne Warwick and “To Love You More” for Celine Dion. The financial specifics of his early film production deals and songwriting royalties from this era are not publicly detailed but contributed to the early stages of his wealth accumulation.

Seagram Company: Transition to Leadership

In the early 1980s, Bronfman transitioned to the family business, becoming the managing director of Seagram Europe. By 1984, he was appointed president of Seagram’s US marketing division. His ascent continued, and in 1994, he became the CEO of Seagram. As CEO, Bronfman strategically shifted Seagram’s focus from alcohol distilling towards the entertainment industry. This transition involved several key acquisitions, including the record label PolyGram and the film companies MCA and Universal Pictures. In 2000, Bronfman spearheaded a controversial all-stock acquisition by the French media conglomerate Vivendi. This deal led to the creation of Vivendi Universal, with Bronfman at its helm. The acquisition, however, ultimately resulted in Seagram losing control of its entertainment assets and beverage division. Although the precise financial details of Bronfman’s compensation during his tenure at Seagram are not fully disclosed, it can be inferred that as CEO, he received substantial salaries, bonuses, and stock options. The Vivendi Universal deal, while transformative, led to significant financial repercussions for the Seagram Company. The financial specifics of these transactions and their impact on Bronfman’s personal wealth remain largely undisclosed. His strategic shift toward entertainment marked a significant change in the trajectory of the company, with implications for his personal wealth.

Accretive LLC and Investment Ventures

Following his departure from Vivendi Universal in late 2001, Bronfman became a managing partner at Accretive LLC in 2002. Accretive LLC is a private investment firm focused on market research, with involvement in companies such as Accretive Health, Fandango, AlphaStaff, and Insureon. As a managing partner, Bronfman’s role involves identifying and investing in promising ventures, contributing to his overall net worth through investment returns and management fees. Specific investment amounts and returns generated by Accretive LLC are not publicly available. In 2017, Bronfman co-founded Waverley Capital with Daniel Leff, a venture capital firm focusing on technology and entertainment companies. This venture further diversifies his investment portfolio. Waverley Capital operates offices in New York and California, investing in various innovative companies. The exact figures and investment strategies of Waverley Capital are not publicly disclosed, but they represent a significant component of Bronfman’s investment activities. As chairman of Endeavor, a New York City-based nonprofit organization, Bronfman supports entrepreneurs and their community impact. He also chairs FuboTV, a streaming television service, leveraging his expertise in the media and entertainment industries. The financial details of his involvement with Endeavor and FuboTV are not publicly detailed, but they contribute to his influence and industry presence.

Warner Music Group: Leadership and Digital Transformation

In early 2004, Edgar Bronfman Jr. assumed the role of CEO of Warner Music Group (WMG). During his tenure, which lasted until the summer of 2011, Bronfman spearheaded the company’s growth by significantly increasing its digital music sales, diversifying its revenue streams, and strengthening relationships with artists. In 2008, WMG’s Atlantic Records became the first major record label to generate more than half of its music sales in the US from digital formats, marking a significant milestone in the industry’s digital transition. In 2011, Bronfman oversaw the sale of WMG to Access Industries for over $3 billion. At the time of the purchase, Access was controlled by Russian-born billionaire Len Blavatnik, who was already a shareholder in WMG. Following the sale, Bronfman stepped down as CEO and was succeeded by Stephen Cooper, remaining chairman until early 2012. While the exact details of Bronfman’s compensation during his time at WMG are not public, it is reasonable to assume that as CEO, he received a substantial salary, bonuses, and stock options. The sale of WMG to Access Industries for $3 billion also likely resulted in a significant payout for Bronfman, contributing to his net worth. Bronfman’s strategic focus on digital music sales transformed WMG into a pioneer in the digital era, bolstering its revenue streams and overall value.

Insider Trading Conviction

In early 2011, Edgar Bronfman Jr. was convicted in a French court for insider trading related to his time as head of Vivendi Universal. He received a 15-month suspended sentence and a fine of €5 million. The suspended jail time was viewed as lenient by many, considering that other executives with similar convictions had been incarcerated. The €5 million fine impacted his financial resources, though the suspended sentence spared him imprisonment. The insider trading conviction and the associated fine remain a notable event in his career, affecting his public image and financial standing.

Personal Life and Family

Bronfman married actress Sherry Brewer in 1979, which led to estrangement from his father, who disapproved of his son marrying a non-Jewish woman. Together, Bronfman and Brewer had three children: Benjamin, Vanessa, and Hannah. They divorced in 1991. In 1993, Bronfman married Clarissa Alcock San Román, also a non-Jewish woman, with whom he has four children: Aaron, Bettina, Erik, and Clarissa. In 2018, Bronfman’s sister, Clare Bronfman, was arrested and indicted on federal charges related to the NXIVM cult. In 2020, she was sentenced to 81 months in prison. While these personal events do not directly impact Edgar Bronfman Jr.’s net worth, they provide context to his family life and the challenges he has faced.

Net Worth Ranker

Net Worth Ranker