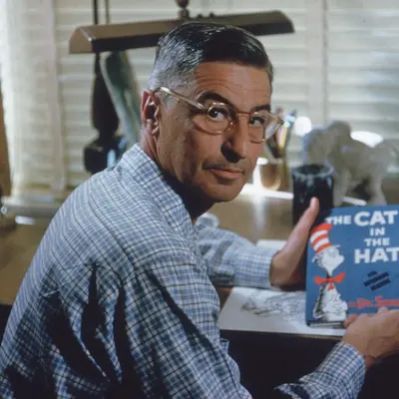

What Is Edward O. Thorp’s Net Worth?

Edward O. Thorp, born on August 14, 1932, in Chicago, Illinois, is an American mathematics professor, author, hedge fund manager, and blackjack player. He has a net worth of $800 million. Thorp’s wealth stems from his successful application of mathematical and statistical principles to both gambling and finance.

Early Life and Education

Edward Thorp displayed an early aptitude for science and mathematics. He was one of the youngest amateur radio operators, getting certified at age 12. Thorp received scholarships for his performance in chemistry and physics competitions, even meeting President Truman. He started college at UC Berkeley in 1949 before transferring to UCLA in 1950 where he earned a Bachelor’s Degree in Physics in 1953. He continued at UCLA and received a master’s degree in 1955, followed by a Ph.D. in mathematics in 1958. He married his wife, Vivian, in January 1956, and they had three children: Raun, Karen, and Jeff.

Career Highlights and Financial Strategies

After receiving his Ph.D., Thorp worked at the Massachusetts Institute of Technology (MIT) from 1959 to 1961. He then became a professor of mathematics at New Mexico State University from 1961 to 1965. From 1965 to 1977, he was a professor of mathematics at the University of California, Irvine, and then a professor of mathematics and finance from 1977 to 1982. Thorp’s academic career provided a foundation for his groundbreaking work in applying probability theory to real-world situations.

Thorp is best known for his book “Beat the Dealer” (1962), which mathematically proved that the house advantage in blackjack could be overcome by card counting. This book sold over 700,000 copies and made it onto the New York Times Bestsellers list, leading to widespread changes in casino practices. He started his applied research using $10,000, with Manny Kimmel providing the venture capital. Their experimental results proved successful, and Thorp won $11,000 in a single weekend.

In 1961, Thorp collaborated with Claude Shannon to create the first wearable computer, designed to improve the odds in roulette. This device gave him an estimated 44% edge in roulette.

Transitioning to finance, Thorp applied his mathematical genius to identify pricing anomalies in the stock market. In 1969, he founded Convertible Hedge Associates, later known as Princeton/Newport Partners (PNP), the first market-neutral hedge fund. PNP compounded at 15.1% annually, after all costs & fees. The annualized standard deviation was only 4% over the entire period, so the fund produced a Sharpe ratio of over 3.0. During the market downturn of 1973-1974, the S&P fell 15.2% in 1973 and 27.1% in 1974, whereas PNP was up 6.5% and 9% over the corresponding periods and never had a losing year during all the time it was in operation.

After Princeton Newport Partners liquidated, Thorp later regrouped as Edward O. Thorp & Associates. In August 1994, Thorp created another partnership, Ridgeline Partners, specialising in Statistical arbitrage. The fund ran through September 2002. The fund’s Sharpe ratio over that time period was an eye-popping 1.88, net of all costs & fees.

In May 1998, Thorp reported that his personal investments yielded an annualized 20% rate of return averaged over 28.5 years. In 1982, Thorp invested in Berkshire Hathaway, recognizing its value-oriented approach. Also, in 1991, Thorp was hired as an investment adviser by an investment committee to evaluate their current portfolio holdings. One of these holdings was with Bernard Madoff Investments, which claimed to use a split strike strategy to generate regular monthly profits. Thorp found many inconsistencies, including faked trades, and recommended the firm sell their Madoff investments, which they duly did.

Net Worth Ranker

Net Worth Ranker