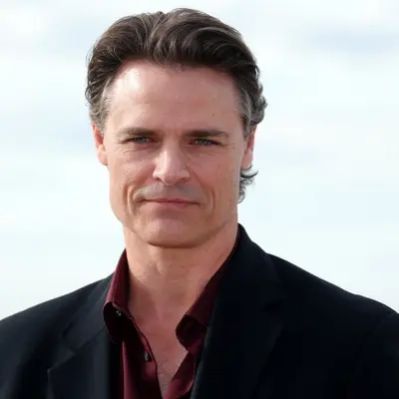

What Is Gabe Plotkin’s Net Worth?

Gabriel “Gabe” Plotkin, an American hedge fund manager, boasts a substantial net worth estimated at $500 million. This valuation reflects his career in finance, primarily through his involvement with hedge funds, including the establishment and management of Melvin Capital Management. His compensation after Melvin’s performance in 2017 was $300 million.

Career and Financial Highlights

Plotkin’s career began after graduating with an Economics degree from Northwestern University in 2001. His early professional years were spent at Citadel LLC and North Sound Capital before he joined SAC Capital. At SAC Capital, Plotkin managed a consumer stocks fund valued at $1.3 billion.

In 2014, following the closure of SAC Capital, Plotkin launched Melvin Capital Management. The firm rapidly accumulated $1 billion in capital. By 2017, Melvin Capital had generated a 47% return on assets. By 2018, the fund’s assets under management had increased to $3.5 billion. The firm concluded 2020 with $12.5 billion under management.

GameStop and Melvin Capital’s Challenges

In early 2021, Melvin Capital faced significant challenges due to the GameStop short squeeze orchestrated by members of the subreddit r/wallstreetbets. Melvin Capital experienced a 30% loss in fund value because of its short position in GameStop. The scale of the losses required a $2.75 billion capital infusion from Point72 and Citadel, granted in exchange for a share of future revenues. In January 2021 alone, Melvin Capital lost 53% on its investments. The fund’s assets decreased from $12.5 billion at the start of 2021 to $8 billion by the end of January, inclusive of the $2.75 billion capital injection.

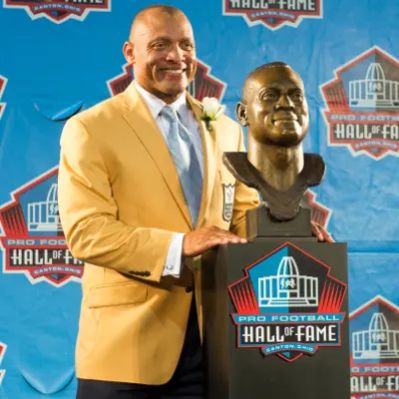

Investment in the Charlotte Hornets

In 2019, Gabe Plotkin, along with another hedge fund manager, acquired a portion of Michael Jordan’s ownership stake in the Charlotte Hornets, an NBA team. This investment valued the Hornets at $1.5 billion.

Real Estate Portfolio

In November 2020, Plotkin invested $44 million in two adjacent homes located on North Bay Road in Miami, Florida. Plans were filed to demolish one of the properties to construct a tennis court and gardens. Plotkin also possesses real estate in New York City.

Net Worth Ranker

Net Worth Ranker