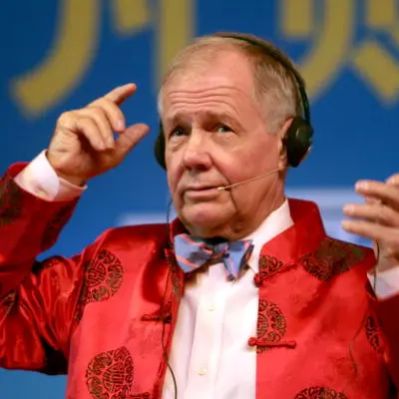

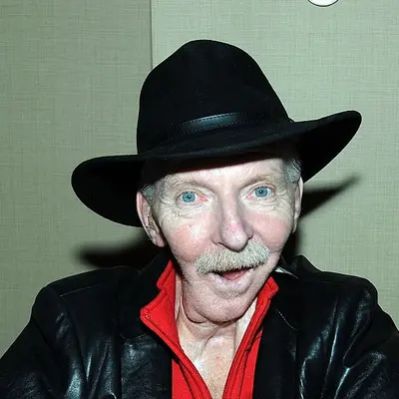

What Is Jim Rogers’ Net Worth?

Jim Rogers, an accomplished American entrepreneur, financial commentator, and author, has accumulated a considerable fortune throughout his career. His net worth is estimated to be around $300 million. This wealth is primarily derived from his successful ventures in investment management, his expertise in global markets, his insightful commentary on economic trends, and his authorship of several well-regarded books on finance and investing.

Early Life and Education: The Foundation of a Financial Mind

Born in Baltimore, Maryland, in 1942, James Beeland Rogers Jr. demonstrated an early aptitude for business. Growing up in Demopolis, Alabama, he launched his first venture at the age of five, selling peanuts. While specific financial figures related to this early business endeavor are unavailable, it instilled in him a fundamental understanding of commerce. Rogers pursued higher education at Yale University, where he earned a degree in History in 1964. Following Yale, he attended Oxford University, obtaining a second bachelor’s degree in Philosophy, Politics, and Economics (PPE). These academic pursuits provided a strong foundation for his future career in finance and investment.

The Quantum Fund and Early Retirement

In the early 1970s, Jim Rogers embarked on his Wall Street career. He joined investment bank Arnhold and S. Bleichroeder. Shortly after he met George Soros. In 1973, Rogers and Soros founded the Quantum Fund. The Quantum Fund was a highly successful hedge fund that generated substantial returns for its investors. Specific financial details of Rogers’ compensation and equity in the Quantum Fund during its operational years are not publicly available, however, due to the fund’s impressive performance, Rogers’ earnings were substantial. After a decade, at the age of 37, Rogers decided to retire from the Quantum Fund. Although the precise figure of his earnings at retirement is not publicly known, this early retirement signifies that he accumulated a substantial financial cushion.

Around the World Adventures and Authorial Ventures

Following his early retirement, Jim Rogers embarked on a series of global adventures. The first one was a motorcycle journey across six continents, which earned him a place in the “Guinness Book of World Records.” These travels laid the foundation for his career as a financial commentator and author. He chronicled his experiences and investment insights in his book, “Investment Biker,” publishing a first hand view of various global economies and investment opportunities. While it’s difficult to precisely quantify the royalties earned from “Investment Biker” and his subsequent books, “Adventure Capitalist” and “Hot Commodities: How Anyone Can Invest Profitably in the World’s Best Market,” these publications have undoubtedly contributed to his overall net worth through book sales, speaking engagements, and increased recognition as a financial expert.

The Rogers International Commodity Index (RICI)

Jim Rogers’ expertise in commodities led him to create the Rogers International Commodity Index (RICI). The RICI is a benchmark for investments in the global commodity markets. While the specific financial arrangements of the RICI’s creation and management are not publicly disclosed, it is clear that the RICI enhanced his reputation as a leading expert in commodity investing. The RICI allows investors to track the performance of a basket of commodities, providing diversification in the commodities market. Rogers is also a public supporter of agricultural investments, offering his insights through media appearances and publications.

Media Appearances and Financial Commentary

Jim Rogers is a frequent guest on financial news programs. He has appeared on shows such as “The Dreyfus Roundtable” and “The Profit Motive with Jim Rogers.” He has also been interviewed and featured in major publications such as The Wall Street Journal, Bloomberg, and Forbes. His media appearances have enhanced his recognition and solidify him as a prominent voice in the investment world. While it’s challenging to quantify the direct financial impact of these appearances, they have undoubtedly contributed to his brand and influence, leading to further opportunities in the form of speaking engagements, consulting work, and increased book sales.

Relocation to Singapore and Family Life

In 2007, Jim Rogers moved to Singapore with his wife, Paige Parker, whom he met in 1996. He has two daughters, Hilton Augusta Rogers and Beeland Anderson Rogers. Rogers has stated that his decision to move to Asia was driven by his belief in the region’s growth potential and investment opportunities. The specific financial implications of this move, such as property investments in Singapore, are not publicly detailed.

Investment Strategies and Asset Allocation

While Jim Rogers’ specific investment portfolio details are not publicly accessible, his general investment strategies are well-known through his books, media appearances, and commentary. He has a strong focus on commodities, particularly agriculture, and emerging markets. Rogers believes that these sectors offer significant growth potential in the long term. His investment philosophy is rooted in identifying macroeconomic trends and investing in undervalued assets. He’s known to take long-term, contrarian positions. It is impossible to say which specific companies Rogers may have invested in or the amounts involved, but given his stated investment preferences, it is reasonable to assume that his portfolio includes holdings in commodity-related companies, agricultural businesses, and emerging market assets. Because Rogers is a private investor, specifics are not available regarding investments. It is presumed that the assets are managed by financial professionals.

Real Estate and Personal Assets

Information regarding Jim Rogers’ real estate holdings and other personal assets is not widely available in the public domain. Details such as the addresses or specific values of his properties are not disclosed. Similarly, information about his ownership of luxury vehicles, such as specific car models or private aircraft, is not readily accessible. These types of assets are often held privately and are not typically included in publicly available financial disclosures.

Net Worth Milestones

While specific year-by-year breakdowns of Jim Rogers’ net worth are not publicly available, it is possible to identify key milestones that have contributed to its growth. His success with the Quantum Fund in the 1970s and early 1980s provided a substantial financial foundation. His subsequent career as an author, financial commentator, and creator of the RICI further enhanced his wealth and reputation. His early retirement at 37 gave him the capital to launch new ventures. Based on these factors and his estimated net worth of $300 million, it is reasonable to assume that his wealth has grown steadily over the decades, reflecting his success in investment, business, and media.

Net Worth Ranker

Net Worth Ranker