What Is John S. Middleton’s Net Worth?

John S. Middleton, an American businessman, possesses a substantial net worth estimated at $3.5 billion. This fortune stems primarily from his family’s legacy in the tobacco industry and his ownership stake in the Philadelphia Phillies. While precise figures regarding the breakdown of his assets are not publicly available, the sale of John Middleton, Inc. played a pivotal role in accumulating his wealth.

The Foundation of Middleton’s Fortune: John Middleton, Inc.

The origins of John S. Middleton’s wealth can be traced back to the founding of John Middleton, Inc. in 1856. Initially established as a tobacco shop in Philadelphia, the company evolved into a major cigar manufacturer under the Middleton family’s stewardship. Specific details about the company’s early revenue and profits are not readily accessible. However, by the time John S. Middleton took the reins, John Middleton, Inc. had risen to become the world’s third-largest cigar manufacturer, showcasing its impressive growth and market dominance.

The company’s flagship product, Black & Mild cigars, became particularly popular, contributing significantly to its overall revenue. While exact annual sales figures for Black & Mild are proprietary, industry analysts have consistently recognized it as a leading brand in the machine-made cigar category. This popularity translated into substantial profits for John Middleton, Inc., further bolstering the family’s net worth.

In 2007, a significant turning point occurred when John Middleton, Inc. was sold to Altria Group, a division of Philip Morris, for nearly $3 billion in cash. This transaction marked a major milestone in the Middleton family’s financial history, instantly converting their ownership in the cigar business into liquid assets. While the specific allocation of these funds among family members remains private, it is clear that John S. Middleton received a substantial share, contributing significantly to his current $3.5 billion net worth.

Philadelphia Phillies Ownership and Impact on Net Worth

Beyond his involvement in the tobacco industry, John S. Middleton is also known for his ownership stake in the Philadelphia Phillies baseball team. He is not the sole owner, but a significant shareholder. The exact percentage of his ownership is not fully public knowledge, though reports suggest a substantial stake. Investments in sports teams tend to appreciate in value over time, and it is reasonable to infer that Middleton’s shares in the Phillies contribute meaningfully to his overall net worth.

The Phillies’ financial performance, including revenue from ticket sales, broadcasting rights, and merchandise, directly impacts the value of the team and, consequently, the value of Middleton’s ownership stake. While detailed financial statements of the Phillies are not publicly available, the team operates as a major revenue-generating entity within Major League Baseball.

While it is difficult to pinpoint the precise financial impact of his Phillies ownership on his overall net worth, it is undoubtedly a significant asset. The value of sports franchises has generally increased substantially in recent years, and the Phillies, as a major market team with a dedicated fanbase, are likely to have experienced similar growth.

Philanthropic Activities and Community Engagement

John S. Middleton and his wife, Leigh, are actively involved in philanthropic endeavors in the Philadelphia area. Their charitable contributions demonstrate a commitment to addressing social issues and improving the lives of local residents. These philanthropic activities do not directly influence his net worth but reflect his values and priorities.

They have made significant donations to various organizations, including a reported $30 million to Project HOME, an organization dedicated to combating homelessness in Philadelphia. This donation has supported Project HOME’s efforts to provide housing, healthcare, and job training to individuals experiencing homelessness. Further details on the specific programs and initiatives funded by this donation are available through Project HOME’s annual reports and public statements.

In addition to their support for Project HOME, the Middletons have also contributed approximately $16 million to Penn Medicine, the medical school and health system of the University of Pennsylvania. These funds have likely been allocated to various research projects, patient care initiatives, and educational programs within Penn Medicine. Specific details on the allocation of these funds can be found in Penn Medicine’s annual reports and fundraising campaigns.

The Middletons have also demonstrated their commitment to education by donating approximately $16 million to local school districts in Philadelphia. These funds have likely been used to support various educational programs, improve school facilities, and provide resources for students and teachers. Specific details on the allocation of these funds can be obtained from the respective school districts’ financial reports and public announcements.

In 2014, John and Leigh Middleton received the Philadelphia Award in recognition of their contributions to improving the quality of life in Philadelphia through their philanthropic activities. This award acknowledged their significant financial support for various community organizations and their dedication to addressing critical social issues.

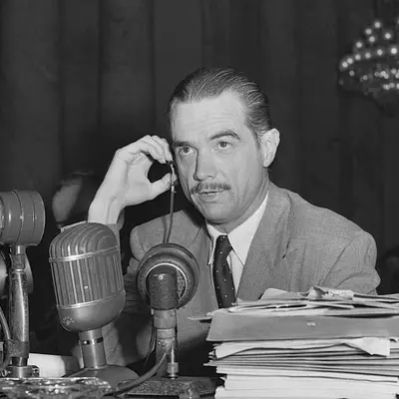

Early Life, Education, and Background

John S. Middleton’s early life and education provided a foundation for his subsequent business success. He graduated from Amherst College in the late 1970s, though the specific details of his academic pursuits are not widely publicized. Amherst College, a prestigious liberal arts institution, likely provided him with a well-rounded education and critical thinking skills that proved valuable in his career. While his specific major and extracurricular activities at Amherst are not publicly available, it is reasonable to assume that he engaged in activities that fostered his leadership and business acumen.

As an heir to the family that founded John Middleton, Inc., John S. Middleton was likely exposed to the business world from a young age. While the specific details of his early involvement in the company are not readily accessible, it is likely that he gained valuable experience and insights into the tobacco industry through observation and mentorship within the family business.

Personal Investments and Assets

While detailed information about John S. Middleton’s personal investments and assets beyond his ownership in the Philadelphia Phillies and the proceeds from the sale of John Middleton, Inc. are not publicly available, it is reasonable to assume that he has diversified his portfolio across various asset classes. These may include stocks, bonds, real estate, and private equity investments. The specific allocation of his assets is likely managed by professional financial advisors, with the goal of maximizing returns while mitigating risk.

Given his substantial net worth, it is possible that Middleton owns luxury properties, such as residences in affluent areas of Philadelphia or vacation homes in other desirable locations. However, specific details about his real estate holdings are not publicly accessible. Similarly, it is possible that he owns luxury vehicles, such as high-end automobiles or private aircraft, but this information is not publicly verifiable.

Without access to detailed financial records, it is impossible to provide a comprehensive overview of Middleton’s personal investments and assets. However, based on his known business ventures and philanthropic activities, it is clear that he has accumulated significant wealth and manages his assets with the assistance of professional financial advisors.

Conclusion on John S. Middleton’s Net Worth

In summary, John S. Middleton’s $3.5 billion net worth is primarily derived from his family’s successful tobacco business, John Middleton, Inc., and his ownership stake in the Philadelphia Phillies. The sale of John Middleton, Inc. to Altria Group in 2007 for nearly $3 billion in cash played a pivotal role in accumulating his wealth. His philanthropic activities, while not directly impacting his net worth, demonstrate his commitment to the Philadelphia community. While specific details about his personal investments and assets are not publicly available, it is reasonable to assume that he has diversified his portfolio across various asset classes to ensure long-term financial security.

Net Worth Ranker

Net Worth Ranker