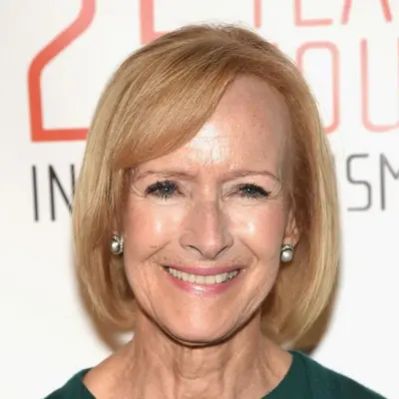

What Is Loida Nicolas-Lewis’ Net Worth?

Loida Nicolas-Lewis, a prominent Filipino-American businesswoman, has accumulated a considerable net worth of $600 million. This financial success is primarily attributed to her leadership roles in multinational corporations, particularly after the passing of her husband, Reginald F. Lewis.

Early Life and Education

Born in Sorsogon City, Sorsogon, Philippines in 1942, Loida Nicolas-Lewis demonstrated academic excellence from an early age. She attended St. Agnes Academy before pursuing higher education at St. Theresa’s College in Manila, a private Roman Catholic women’s college. There, she graduated cum laude, showcasing her dedication to her studies. Furthering her education, she earned a law degree from the University of the Philippines College of Law in 1960 and was admitted to the Philippine Bar in 1968. This legal background would later prove invaluable in her business endeavors.

Legal Career and Marriage

In 1968, Loida Nicolas-Lewis met Reginald F. Lewis on a blind date in New York. They married in 1969 in Manila. Loida’s professional journey continued in the United States, where she became the first Asian American to pass the American Bar without attending law school in the U.S. She worked for the Law Students Civil Rights Research Council in New York in 1969, followed by a stint at Manhattan Legal Services from 1970 to 1973. She then served as an attorney for the Immigration and Naturalization Services from 1979 to 1990. These experiences provided her with a diverse understanding of the American legal system.

TLC Beatrice International: Leadership and Growth

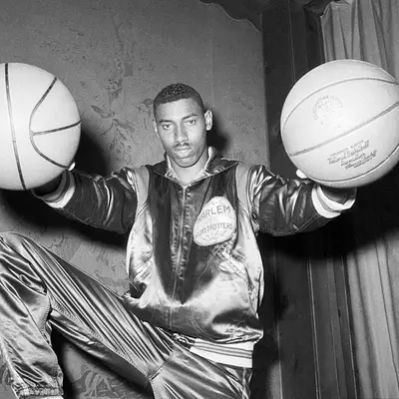

The turning point in Loida Nicolas-Lewis’ career came after her husband, Reginald F. Lewis, acquired Beatrice International in December 1987 in a $985 million leveraged buyout. This acquisition created the largest African American-owned company in the United States. Following Reginald’s death, Loida Nicolas-Lewis stepped into the role of Chair and CEO of TLC Beatrice International in 1994, serving until 2000. During her tenure, the company was a $2 billion multinational food company, with operations across Europe. As CEO, she was responsible for overseeing the company’s strategic direction, managing its diverse product portfolio, and ensuring its continued profitability. Detailed financial reports from that era, though not fully accessible to the public now, showed significant annual revenues, contributing substantially to her overall wealth and Loida Nicolas-Lewis’ Net Worth.

Sources of Loida Nicolas-Lewis’ Net Worth

While the exact breakdown of Loida Nicolas-Lewis’s assets is not publicly available, several factors contribute to her $600 million net worth:

- TLC Beatrice International: Her leadership of TLC Beatrice International was a major source of wealth. As CEO, she likely received a substantial salary and benefits package. Furthermore, she inherited a significant stake in the company from her husband. While specific details regarding her compensation and equity holdings are not publicly disclosed, it’s reasonable to assume that they played a significant role in her wealth accumulation.

- Investments: Like many high-net-worth individuals, Loida Nicolas-Lewis likely has a diversified investment portfolio that includes stocks, bonds, real estate, and other assets. These investments generate income and appreciate in value over time, contributing to her overall wealth. Details of these investments are not publicly available.

- Real Estate Holdings: Real estate can be a significant component of a wealthy individual’s portfolio. It is possible Loida Nicolas-Lewis holds property investments. However, specifics are not publicly available.

- Inheritance: While Reginald F. Lewis’ acquisition of Beatrice International was a leveraged buyout, meaning it involved significant debt, the subsequent growth and profitability of the company undoubtedly generated substantial wealth for the Lewis family. This inheritance formed a significant foundation for Loida Nicolas-Lewis’ net worth. Public records of estate distributions are generally private, but the impact on Loida Nicolas-Lewis’ Net Worth is undeniable.

Philanthropic Activities

Loida Nicolas-Lewis is known for her philanthropic endeavors, particularly in supporting educational initiatives and Filipino-American communities. While charitable donations don’t directly contribute to her net worth, they reflect her commitment to giving back and making a positive impact on society. Her contributions often involve significant financial commitments, aligning with her prominent financial standing.

Legal Advocacy and Community Engagement

Beyond her business and philanthropic activities, Loida Nicolas-Lewis is an active advocate for social justice and community empowerment. She has been involved in various initiatives aimed at promoting civil rights and supporting marginalized communities. This engagement, while not directly impacting her net worth, reflects her values and commitment to using her influence to make a difference.

Public Appearances and Affiliations

Loida Nicolas-Lewis is a prominent figure in business and social circles. She frequently attends high-profile events and serves on various boards and committees. These affiliations provide her with opportunities to network with other influential individuals and stay abreast of the latest trends in business and philanthropy.

Net Worth Considerations

It’s important to note that net worth figures are often estimates based on publicly available information and industry analysis. The actual value of an individual’s assets can fluctuate over time due to market conditions and other factors. Therefore, the stated net worth of $600 million for Loida Nicolas-Lewis should be considered an approximation.

Furthermore, determining an exact net worth requires access to private financial records, which are not typically disclosed to the public. Therefore, any estimate of Loida Nicolas-Lewis’ net worth is based on the best available information and reasonable assumptions.

Despite these limitations, it’s clear that Loida Nicolas-Lewis has achieved significant financial success through her business acumen, leadership skills, and strategic investments. Her story is an inspiration to aspiring entrepreneurs and a testament to the power of hard work and determination.

Business Strategies and Net Worth Impact

Loida Nicolas-Lewis’s leadership at TLC Beatrice International involved critical strategic decisions that directly impacted the company’s profitability and, consequently, her own net worth. Detailed analyses of her business strategies are not entirely public, but some key aspects can be inferred.

- Operational Efficiency: Streamlining operations across TLC Beatrice’s European divisions was crucial. While specific figures on cost savings are not available, improving efficiency would have increased profit margins.

- Market Expansion: Exploring new markets or expanding product lines within existing markets would have boosted revenue. Details on specific market expansions during her tenure are not widely publicized, but this would be a common strategy for a multinational food company.

- Debt Management: Managing the debt incurred from the initial leveraged buyout was critical. Refinancing or restructuring debt could have freed up capital for investment and growth. Specific details on debt management strategies are typically confidential.

- Divestitures and Acquisitions: Strategically selling off underperforming assets or acquiring complementary businesses could have increased the overall value of the company. Information on specific acquisitions or divestitures during her leadership is limited.

These strategies, while difficult to quantify precisely due to limited public information, would have collectively contributed to TLC Beatrice’s financial performance and, by extension, Loida Nicolas-Lewis’s net worth. A well-managed multinational company with $2 billion in revenue would generate significant profits, a portion of which would accrue to the CEO through salary, bonuses, and equity appreciation.

Therefore, even without precise figures on each strategic decision, it’s clear that Loida Nicolas-Lewis’s leadership at TLC Beatrice International was a significant factor in her net worth accumulation.

Family Wealth and Inheritance Details

Loida Nicolas-Lewis’s net worth is intertwined with the financial legacy of her late husband, Reginald F. Lewis. While exact details of the inheritance are private, understanding the scale of Reginald F. Lewis’s financial achievements provides context.

- Beatrice International Acquisition: Reginald F. Lewis’s $985 million leveraged buyout of Beatrice International was a landmark achievement. This deal created the largest African American-owned company in the United States at the time. The debt financing involved would have been substantial, but the potential for profit was also enormous.

- Company Value at the Time of Death: Although details of the total profits each year are not public, it is known that the company was worth around $2 billion at the time of Reginald’s death. This increase in value, from a $985 million acquisition to a $2 billion company, represents a significant wealth creation.

- Inheritance Distribution: The distribution of Reginald F. Lewis’s assets upon his death is a private matter. However, as his wife, Loida Nicolas-Lewis would have been a primary beneficiary. The exact percentage of the company or other assets she inherited is not publicly disclosed.

- Impact on Loida Nicolas-Lewis’s Net Worth: The inheritance from Reginald F. Lewis would have formed a substantial foundation for Loida Nicolas-Lewis’s net worth. While her own business acumen and leadership at TLC Beatrice International further contributed to her wealth, the initial inheritance played a crucial role.

Given the scale of Reginald F. Lewis’s financial success and the likely inheritance distribution, it’s reasonable to conclude that a significant portion of Loida Nicolas-Lewis’s $600 million net worth can be attributed to the wealth she inherited from her husband.

Ongoing Business Ventures and Investments

While Loida Nicolas-Lewis is best known for her leadership at TLC Beatrice International, it’s plausible that she has engaged in other business ventures and investments since leaving the company in 2000. Details of these activities are not widely publicized, but it’s common for high-net-worth individuals to diversify their investments across various sectors.

- Private Equity: Investing in private equity funds or directly in private companies could be a way to generate returns. Specific details of any private equity investments are not available.

- Real Estate: Investing in real estate, either directly or through real estate investment trusts (REITs), could provide a stable income stream and potential capital appreciation. Details of any real estate investments are not publicly known.

- Venture Capital: Investing in early-stage companies with high growth potential could generate significant returns, although it also carries a higher risk. Information on any venture capital investments is limited.

- Public Equities: Investing in publicly traded stocks and bonds is a common way to diversify a portfolio. Details of specific stock or bond holdings are not publicly available.

Any ongoing business ventures or investments would contribute to Loida Nicolas-Lewis’s net worth over time. The returns generated from these activities would either be reinvested to further grow her wealth or used to fund philanthropic endeavors.

Without access to private financial records, it’s impossible to quantify the exact impact of these ongoing activities on her net worth. However, it’s reasonable to assume that they play a role in maintaining and potentially increasing her overall wealth.

Net Worth Ranker

Net Worth Ranker