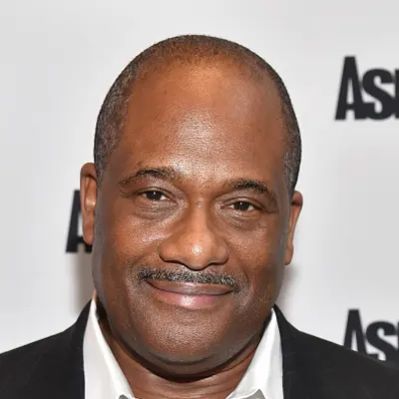

What Is Michael Wirth’s Net Worth?

Michael Wirth, an accomplished American businessman and executive, has an estimated net worth of $50 million. This financial standing is largely attributed to his successful career, particularly his leadership role at Chevron Corporation.

Michael Wirth’s Compensation at Chevron Corporation

A significant portion of Michael Wirth’s net worth stems from his compensation as Chairman and CEO of Chevron Corporation. In a typical year, his total compensation approximates $20 million. This includes a base salary of $1.6 million. This substantial income reflects his responsibilities in overseeing the operations of one of the world’s leading integrated energy companies.

Michael Wirth’s Chevron Stock Holdings

Another factor contributing to Michael Wirth’s net worth is his ownership of Chevron stock. As of January 2020, he held approximately 32,000 shares of Chevron. The value of these shares fluctuates with the stock market, influencing his overall financial status. Changes in stock value can significantly affect his net worth either positively or negatively.

Early Life and Education

Born in 1960, Michael Wirth’s early life laid the foundation for his future achievements. He earned his degree from the University of Colorado Boulder, an institution known for its strong engineering and business programs. This educational background provided him with the necessary knowledge and skills to excel in the corporate world. Although specific details about his childhood and upbringing are not widely available, his education at a reputable university clearly played a role in shaping his career trajectory.

Career Ascent at Chevron Corporation

Michael Wirth’s career at Chevron Corporation is a testament to his leadership and business acumen. He was elected Chairman of the Board and Chief Executive Officer in 2017, officially assuming these roles in 2018. Before this, he served as Vice Chairman of the Board in 2017. From 2016 to 2018, he held the position of Executive Vice President of Midstream & Development for Chevron Corporation. These roles provided him with extensive experience in various aspects of the energy industry.

Executive Roles and Responsibilities

From 2006 to 2015, Michael Wirth served as Executive Vice President of Downstream & Chemicals. Prior to this, he was President of Global Supply and Trading from 2003 to 2006. In 2001, he was named President of Marketing for Chevron’s Asia, Middle East, and Africa business. Each of these positions involved significant responsibilities, including overseeing operations, managing budgets, and making strategic decisions. These experiences have undoubtedly contributed to his overall financial success and net worth.

Board Memberships and Affiliations

Michael Wirth’s influence extends beyond Chevron Corporation, as he has served on the board of directors for GS Caltex Corporation and Caltex Australia Limited. Additionally, he has been involved with various organizations, including Catalyst, the American Petroleum Institute, and the International Business Council of the World Economic Forum. These affiliations highlight his standing in the business community and his engagement with important industry issues. While these roles may not directly impact his net worth, they enhance his reputation and influence.

Compensation Details and Breakdown

Analyzing Michael Wirth’s compensation structure offers insight into the components that make up his substantial income. The base salary of $1.6 million is just one element of his overall earnings. In addition to the base salary, he receives significant compensation in the form of stock options, performance-based bonuses, and other benefits. These additional forms of compensation are tied to Chevron’s financial performance and his contributions to the company’s success. Stock options allow him to purchase company shares at a predetermined price, which can be profitable if the stock price increases. Performance-based bonuses reward him for achieving specific financial or operational targets. Other benefits may include retirement plans, health insurance, and other perks that contribute to his overall financial well-being.

Analyzing Stock Options and Bonuses

The detailed breakdown of Michael Wirth’s compensation package reveals how stock options and bonuses significantly influence his net worth. Stock options, granted as part of his executive compensation, provide the opportunity to acquire Chevron shares at a set price over a specific period. If Chevron’s stock performs well, these options can translate into substantial gains when exercised. Performance-based bonuses, on the other hand, are typically tied to Chevron’s profitability, operational efficiency, and strategic achievements. By consistently meeting or exceeding performance targets, Wirth can accumulate significant bonus income, further boosting his overall financial standing. These incentives align his interests with those of Chevron’s shareholders, driving him to maximize long-term value for the company.

The Impact of Chevron’s Performance on Wirth’s Net Worth

The fluctuations in Michael Wirth’s net worth are closely linked to Chevron’s performance in the global energy market. As a leading integrated energy company, Chevron’s financial results are influenced by a variety of factors, including oil prices, production volumes, refining margins, and geopolitical events. When Chevron performs well, its stock price tends to increase, thereby enhancing the value of Wirth’s stock holdings and potentially leading to higher bonus payouts. Conversely, if Chevron faces challenges, such as declining oil prices or operational setbacks, its stock price may decline, negatively impacting Wirth’s net worth. Therefore, understanding Chevron’s performance is crucial for tracking the changes in Wirth’s financial status.

Potential Real Estate Holdings

While specific details regarding Michael Wirth’s real estate holdings are not publicly available, it is reasonable to assume that he owns one or more properties given his substantial income and net worth. High-net-worth individuals often invest in real estate as a way to diversify their assets and generate long-term appreciation. These properties could include primary residences, vacation homes, or investment properties. The value of these holdings would contribute to his overall financial picture.

Potential Personal Investments

Apart from his compensation and Chevron stock holdings, Michael Wirth likely has other personal investments that contribute to his net worth. These investments could include stocks, bonds, mutual funds, private equity, or other alternative assets. Diversifying investments across different asset classes can help mitigate risk and enhance returns over time. The specific details of these investments are not publicly known, but they would play a role in shaping his overall financial status.

Philanthropic Activities

While not directly impacting his net worth, Michael Wirth’s philanthropic activities and charitable contributions reflect his values and social responsibility. High-profile executives often engage in philanthropy as a way to give back to the community and support causes they believe in. Wirth may donate to educational institutions, environmental organizations, or other charitable causes aligned with his interests. These activities enhance his reputation and demonstrate his commitment to making a positive impact on society. Although these contributions are not factored into his net worth, they are an important aspect of his overall profile.

Market Fluctuations and Net Worth Volatility

It’s important to recognize that Michael Wirth’s net worth is subject to market fluctuations and economic conditions. The value of his Chevron stock holdings can rise or fall based on investor sentiment, industry trends, and global events. Changes in interest rates, inflation, or other economic factors can also impact the value of his investments. As a result, his net worth is not a static figure but rather a dynamic measure that changes over time. These market-related factors need to be considered when assessing his financial status.

Estimating Future Net Worth

Predicting Michael Wirth’s future net worth is challenging, as it depends on a variety of factors, including Chevron’s performance, market conditions, and his investment decisions. If Chevron continues to thrive and its stock price appreciates, his net worth is likely to increase. Conversely, if Chevron faces significant challenges or market downturns, his net worth could decline. His personal investment decisions and spending habits will also influence his future financial status. While it’s impossible to provide an exact forecast, understanding these factors can offer insights into the potential trajectory of his net worth.

Net Worth Ranker

Net Worth Ranker