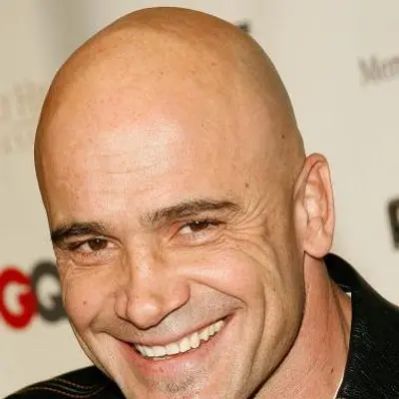

What Is Nick Leeson’s Net Worth?

Nick Leeson, a former derivatives trader infamous for his role in the collapse of Barings Bank, has a reported net worth of $4 million. This figure reflects his post-prison career, primarily as a speaker and advisor, and his past experiences which include writing books and having his story adapted into a movie.

Nick Leeson’s Financial Breakdown

At his peak in the early 1990s while working for Barings Bank, Nick Leeson earned over $1 million annually through salary and bonuses. This substantial income was a contributing factor to the lifestyle he maintained before the exposure of his fraudulent activities. After his conviction in Singapore, Leeson was held personally liable for £100 million. This liability significantly impacted his financial situation, capping his income, with anything earned above the set cap going toward settling the judgment. Even earnings from his book “Rogue Trader” and its film adaptation were allocated to pay down this substantial debt.

The statute of limitations eventually expired, allowing Leeson to retain 100% of his post-tax income. Today, the majority of his income stems from his work as a paid speaker. He commands between $10,000 and $20,000 per speaking engagement. This income reflects his ability to share his experiences and insights on risk management and corporate responsibility, derived from his past experiences at Barings bank.

Early Life and Career Beginnings

Nick Leeson was born on February 25, 1967, in Watford, Hertfordshire, England, on a council estate. This upbringing provides a backdrop to his later career in the high-stakes world of finance. His early life was rooted in a working-class environment. Leeson attended Parmiter’s School in nearby Garston, setting the stage for his future career.

He began his career as a clerk at the Lombard Street branch of Coutts private bank, marking his entry into the financial sector. In 1987, he moved to Morgan Stanley’s futures and options back office, where he was involved in clearing and settling listed derivatives transactions. These roles provided him with foundational knowledge that would later influence his actions and decisions at Barings Bank.

The Rise and Fall at Barings Bank

In 1989, Leeson joined Barings Bank in London, one of the oldest merchant banks in England. The following year, he was transferred to Barings’ office in Jakarta, Indonesia. In 1991, back in London, Leeson investigated a fraud case involving a Barings employee who had used a client’s account for proprietary trading. In 1992, he became the general manager of Barings’ newly opened futures and options office in Singapore, despite falsifying information on his application.

From 1992 onwards, Leeson engaged in unauthorized speculative trades that initially generated significant profits for Barings. Simultaneously, he utilized one of Barings’ error accounts to conceal his and his associates’ bad trades and growing losses. On one occasion, Leeson concealed the fact that he had failed to reconcile a discrepancy of 500 contracts, resulting in a loss of $1.7 million for Barings. Although he claimed to have never personally benefited from the error account, investigators uncovered approximately $35 million in his various bank accounts.

By the end of 1994, the losses in Leeson’s error account at Barings had increased to £208 million. This situation arose due to his doubling strategy, in which he would double the amount he lost after each loss in an attempt to recover the initial amount. As his losses accumulated, Leeson fabricated cover stories to justify his need for more cash from London. His actions came to a head in early 1995 when he placed a short straddle in the Singapore and Tokyo stock exchanges, betting that the Japanese stock market would remain stable overnight. However, the Great Hanshin Earthquake struck Japan the next morning, severely impacting Asian markets and Leeson’s trading positions.

He unsuccessfully attempted to recover his losses through a series of high-risk trades before fleeing Singapore. Leeson’s losses eventually reached £827 million, which was twice the available trading capital of Barings. Following a failed bailout attempt, Barings was declared insolvent at the end of February 1995, marking one of the most significant financial collapses in history.

Conviction, Incarceration, and Post-Prison Career

After fleeing Singapore, Leeson made stops in Malaysia, Thailand, and Germany, where he was arrested in Frankfurt and extradited back to Singapore. He pleaded guilty to two counts of “deceiving the bank’s auditors and of cheating the Singapore exchange.” District Judge Richard Magnus convicted Leeson and sentenced him to six-and-a-half years in Singapore’s Changi Prison. Due to good behavior, he was released in the summer of 1999 after serving four years and four months.

Following his release, Leeson completed a degree in psychology at Middlesex University. He also began offering speaking engagements and advising companies on risk and corporate responsibility. In 2005, Leeson became the commercial manager of the Irish association football club Galway United and later became its general manager. By 2007, he was the club’s CEO. He left Galway United in early 2011 due to financial difficulties experienced by the club. In 2023, he became a private investigator of financial misconduct cases for the corporate intelligence firm Red Mist Market Enforcement Unit.

Published Works and Film Adaptation

Leeson published his autobiography, “Rogue Trader,” in 1996. The book, which chronicles his fraudulent acts that led to the collapse of Barings Bank, was adapted into a film of the same name in 1999, with Ewan McGregor portraying Leeson. Leeson published another book, “Back from the Brink: Coping with Stress,” in 2005, featuring conversations with psychologist and educator Ivan Tyrrell.

Personal Life

Leeson married his first wife, Lisa Sims, in 1992, after they met in Jakarta, where they both worked for Barings. The couple divorced in 1997 following Leeson’s arrest. In 2003, four years after Leeson was released from prison, he married Leona Tormay.

The ability to deliver speeches that command fees ranging from $10,000 to $20,000 demonstrates a clear demand for his perspective, further solidifying his current financial standing as reflected in his $4 million net worth. It is also important to consider that the journey of Nick Leeson has resulted in Nick Leeson’s current net worth.

Nick Leeson’s net worth is also influenced by his past roles and experiences.

Understanding Nick Leeson’s net worth requires looking at various phases of his professional and personal life, from working at Barings to writing books and advisory roles.

The information available suggests that Nick Leeson’s net worth stands at $4 million.

The impact of Nick Leeson’s decisions on Barings Bank has played a significant role in his financial and professional trajectory.

Net Worth Ranker

Net Worth Ranker