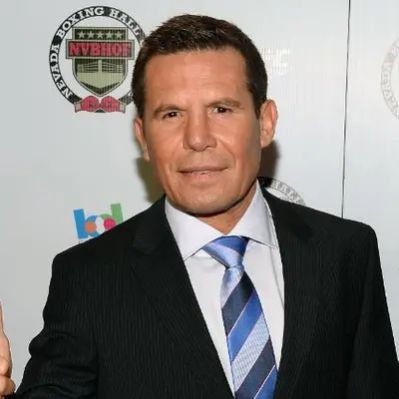

What Is Travis VanderZanden’s Net Worth?

Travis VanderZanden, an American entrepreneur celebrated for his role as the founder and former CEO of Bird, the electric scooter-sharing company, has accumulated a net worth estimated at $30 million. This valuation reflects his successes and challenges throughout his career, especially concerning Bird’s financial trajectory.

Early Career and Ventures Before Bird

Before establishing Bird in 2017, VanderZanden gained diverse experience across multiple tech companies. After graduating from the University of Wisconsin-Eau Claire, he started as a product manager at Qualcomm in 2002. Later, he earned an MBA from the USC Marshall School of Business, enhancing his business acumen and paving the way for future entrepreneurial endeavors. In 2009, he became the Chief Revenue Officer (CRO) at Yammer, an enterprise chat service, staying until 2011. VanderZanden then co-founded Cherry, an on-demand car wash service, where he served as CEO until its acquisition by Lyft in 2013. Following the acquisition, he joined Lyft as its Chief Operating Officer (COO) before leaving to take on the role of VP of International Growth at Uber. However, Lyft sued him for breaching a confidentiality agreement, which was later settled privately. The details surrounding the financial terms of this settlement remain undisclosed.

The Rise and Fall of Bird

VanderZanden founded Bird in 2017, and the company quickly gained prominence, launching its scooter-sharing services in Santa Monica, California, and expanding to numerous cities. The company’s scooters quickly gained popularity but also sparked significant controversy regarding safety and regulatory compliance. Bird did not obtain the required permits before operating in various cities, leading to friction with local authorities and numerous safety concerns due to riders using sidewalks and ignoring traffic rules. By 2019, Bird operated in 120 cities globally, facing increasing competition from other scooter-sharing companies.

Bird’s rapid growth attracted significant venture capital investments. In February 2018, Bird secured $15 million in Series A funding, followed by $100 million in a Series B round a month later. In May 2018, a Series C round led by Sequoia Capital raised $150 million, valuing the company at $1 billion, making it one of the fastest companies to achieve “unicorn” status. By June 2018, Bird raised $300 million, boosting its valuation to $2 billion. The company’s private valuation peaked at $2.8 billion following subsequent funding rounds. These investments totaled over $400 million. It is estimated that during Bird’s funding rounds, VanderZanden might have personally cashed out around $100 million. Specifically, he reportedly took $44 million during the mid-2018 funding rounds. As equity stakes were diluted through multiple funding rounds, VanderZanden’s stake was estimated to be around 20% during the later rounds. This stake would have been worth around $415 million before taxes when the company was valued at $2 billion.

Bird went public via a Special Purpose Acquisition Company (SPAC) merger in November 2021, valuing the company at $2.5 billion. At the time of the IPO, VanderZanden’s equity stake had been reduced to approximately 13%, worth about $325 million based on the initial share price of around $8. However, within a year, the company’s stock plummeted from a 52-week high of $11.25 to just $0.34 per share. Bird’s market capitalization declined dramatically from $2.5 billion to around $70 million. This reduced the value of VanderZanden’s 13% stake to about $9 million. Travis VanderZanden stepped down from his role as CEO in September 2022.

By December 2023, Bird’s market cap had further dwindled to $7 million. Subsequently, the company was delisted from the New York Stock Exchange (NYSE) due to its inability to maintain a market capitalization above $15 million. In January 2024, Bird filed for bankruptcy, marking a significant downturn from its peak valuation.

Real Estate Investments

VanderZanden has also invested in real estate. At one point, his real estate holdings were valued at around $40 million, spread across properties in Los Angeles and Florida. In November 2018, he purchased a newly constructed home in Santa Monica, California, for $8 million in cash. He sold this property in July 2021 for $9 million, realizing a profit on the sale.

In January 2021, VanderZanden acquired Trevor Noah’s Bel Air mansion for $21.7 million. However, he listed the property for sale just six months later, initially asking for nearly $25 million. He later reduced the price to $19.9 million in October 2022. The sale status of this property as of late 2023 was not confirmed, but it appears that he did not find a buyer at that time.

In November 2021, VanderZanden purchased a waterfront mansion in Coral Gables, Florida, for $21.8 million. He listed this property for $33 million in March 2023. The property was ultimately sold for $26 million in January 2024. In November 2023, VanderZanden bought a home in Miami for $6.8 million. He listed this property for sale in March 2024 for $8.49 million. Further details about the final sale of the Miami property are not available.

Travis VanderZanden’s Net Worth and Financial Overview

Given the information available, Travis VanderZanden’s net worth of $30 million is influenced by factors such as early career gains, Bird’s financial performance, and his real estate investments. The fluctuating valuations of Bird, along with the real estate market, have influenced VanderZanden’s overall net worth. Although he made significant gains during Bird’s peak and through real estate transactions, the subsequent decline of Bird’s market value and potential losses from real estate investments have impacted his financial status. It is estimated that Travis VanderZanden took $100 million off the table personally during Bird’s various funding rounds.

Net Worth Ranker

Net Worth Ranker